Ksapa recently organized a webinar focusing on the emergence of voluntary carbon markets (VCM) and their effectiveness in driving the transition to a low-carbon economy. With the increasing urgency to tackle climate change on a global scale, new opportunities offered by VCMs appear promising. Indeed, as the number of companies committing to Net Zero is increasing, VCMs provide an innovative framework to channel financing towards projects able to deliver on such targets. As such, a strong growth is expected with an up to 15-fold increase in demand for carbon credits expected by 2030. However, recent controversies have emerged questioning the environmental impact of voluntary projects and shedding light on human rights infringement cases. Several questions then arise: how can progress climate change be tackled while allowing developed countries to offset emissions? How to ensure homogenous quality across projects? How to ensure human rights of indigenous populations are upheld?

To share actionable strategies, methodologies, and collaborative initiatives, we welcomed the insights of Carla Orrego, Manager at Climate Policy Initiative, Hugh Salway, Senior Director for Market Development & Partnerships at the Gold Standard Foundation, and Adrien Covo, Senior Program Officer at Ksapa.

Recent Controversies Rocking VCMs

While VCMs have existed for quite some time, they have come under the limelight in recent years due to controversial projects. Indeed, investigations conducted by several organizations have pointed out the low environmental quality of some projects. For example, a Guardian article from last year revealed the inaccuracies of some methodologies, in particular conservation projects, where deforestation rates are overestimated to inflate the forecasted & later the measured impact of the project in the area. Likewise, several issues have been identified, such as static baselines or double counting, that could question voluntary projects’ actual environmental impact.

In addition, voluntary projects have also been criticized for the human rights infringements suffered by some local populations. With the increasing value of nature & its commoditization through credits, predatory practices have become standard practices in some areas. As such, some projects have been accused of evicting indigenous communities (Ogiek people in Kenya for example), land grabbing, or forced labor (forced Uyghur labor in China).

It is important to note that all voluntary carbon projects are concerned: from renewable energy to agriculture. However, ensuring social & environmental value is even more complex for agriculture & land use projects (AFOLU) considering the difficult context and diversity of stakeholders to be involved.

Though recent criticism may have negatively impacted markets, constructive criticism is needed. Indeed, external evaluation of existing frameworks & methodologies is key for such a nascent market. VCMs offer an innovative financing model which needs continuous improvement to fully deliver on its promise.

Ensuring VCMs Integrity

REFRAMING THE ROLE OF VCM

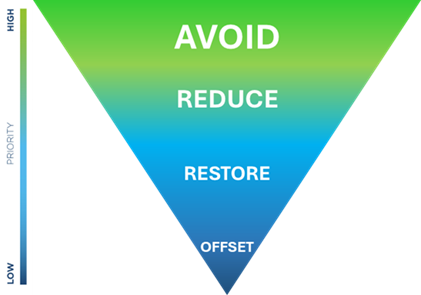

When considering VCMs, it is necessary to take a step back and reframe their role in the larger context of climate change mitigation. In fact, with corporates increasingly establishing science-based targets, the role of offsetting must be clarified to ensure effective strategies. In that sense, all mitigation strategies should be guided by the mitigation hierarchy which prioritizes mitigation actions. Offsetting should only be used as a last resort!

Additionally, IPCC’s 1.5 model specifically highlights the need for fossil fuel emissions reductions before carbon removals.

STEPPING-UP CREDITS CLIMATE INTEGRITY

While all credits can be used by any company to offset its irreducible emissions, not all credits are created equal!

To assess the environmental performance, or integrity, of a credit, 3 dimensions are used:

- Verified: actual emissions must be scientifically measured & verified

- Additional: sequestration or avoidance would not have taken place without carbon project

- Permanent: carbon sequestered must be stored for a long period (benchmark of 100 years).

However, divergences in methodologies, monitoring process, carbon standard, may impact the quality of a credit. Considering that functioning markets rely on selling & purchasing interchangeable units (credits), it is critical to ensure homogeneity across credits issued. In that respect, some initiatives have emerged in recent years to standardize integrity principles allowing to define quality standards for credits. Among those, the Task Force on Scaling Voluntary Carbon Markets led by Mark Carney is worth noting.

It is also interesting to note that certain standards, such as Gold Standard, have already taken steps to increase integrity of credits. As explained by Hugh Salway, Gold Standard has for example decided to forbid certification of REDD+ projects due to concerns on the quantification of impacts (recent articles proved them right), and they are continuously reviewing their methodologies which can lead to cancellation of already issued credits in an effort to reflect the actual impact delivered on climate by projects.

While such initiatives are needed to standardize markets, their scope is narrow and primarily focused on climate integrity. Ensuring climate integrity is of course the first step to impactful VCMs but efforts should also go beyond climate and address all ESG risks.

COMPLEMENTING VCM INTEGRITY

Integrity as it is currently understood and envisioned is too narrow-focused. Indeed, with most of the attention being directed to climate, VCM have developed a blind spot with regards to other ESG risks: climate action should not come at the expense of other social issues that need to be addressed. In that sense, VCM projects should deliver climate action on the one hand, while being mindful of other ESG risks or dimensions to ensure no negative impacts on the other hand. A good example is the recurring lack of consideration and respect for indigenous people’s rights: projects focus on delivering climate action but do not involve indigenous populations, which are first impacted, in any decision-making processes or worse, violate their rights.

While adopting an ESG risk management approach will help ensure no negative impacts, going beyond the traditional “do no harm” stance and actively contributing to the SDGs is necessary. Indeed, VCMs have the potential to be transformative at local level. By complementing climate action with social action, as well as by sharing benefits, VCMs ensure that the project will be adopted and supported by local communities thus legitimizing their status in host countries.

Such multidimensional projects are increasingly sought after by carbon investors & off-takers looking to contribute to several development challenges. In response, many standards are pushing project developers to adopt such a strategy. For example, VERRA standard has developed a new standard to reward community action & biodiversity preservation. Going further, Gold Standard requires projects to intentionally contribute to two SDGs minimum in addition to climate mitigation. Additionally, new standards have emerged in recent years with innovative approaches to environmental and social integrity. For example, Rabobank’s ACORN platform relies exclusively on remote sensing to monitor biomass stocks and requires projects to give back 80% of proceeds to local stakeholders.

Among the issues related to social action, equitable benefit-sharing is key. Indeed, to be able to anchor projects in rural territories on the long-term, communities impacted must get a fair share of the benefits generated. In that sense, it is interesting to note a growing trend among host countries to regulate such benefits-sharing. As mentioned by Hugh Salway, many African countries are now explicitly setting a mandatory percentage of benefits that must go back to local communities.

Strategies to Design Impactful VCM Projects

BALANCING SOCIAL ACTION & PROFITABILITY

Even though social action appears key to legitimize VCM in host countries, it may impede projects’ profitability. Indeed, when considering agriculture projects for example, working with vulnerable populations such as smallholder farmers induces more complexity to design and implement the project. Such complex projects require strong operational organization to engage and support local communities. Moreover, while multidimensional projects are increasingly favored on the market, they inherently translate into higher costs as it requires multiple interventions and continuous support.

Innovative instruments such as VCM have thus emerged to bridge the financing gap between developers and investors, channeling millions towards impactful projects. However, the financial incentive offered by VCM might not always be enough to compensate for the risks and investment needed to undertake multidimensional projects. In that sense, combining several instruments can prove profitable:

- On the one hand, impact-linked finance instruments (such as carbon credits) allow to improve the bankability of projects by incentivizing impact delivery in emerging markets.

- On the other hand, blended finance structures (blending concessional and commercial capital) allow to decrease risks for investors and thus to crowd-in additional money.

Some projects have successfully leveraged those instruments to create innovative frameworks allowing them to deliver multiple impacts while maintaining an attractive risk-return profile for investors. For example, the Tambopata-Bahuaja project, spearheaded by Althelia fund, designed the following structure:

- Fund is backed by USAID guarantee covering part of portfolio

- Fund provides below-market rate loan to NGO to conduct activities

- NGO leverages carbon credits to repay loan

However, designing such bankable solutions able to deliver both impact & return is complex: it requires expertise, time, and capital.

ADDRESSING LACK OF INVESTABLE SOLUTIONS

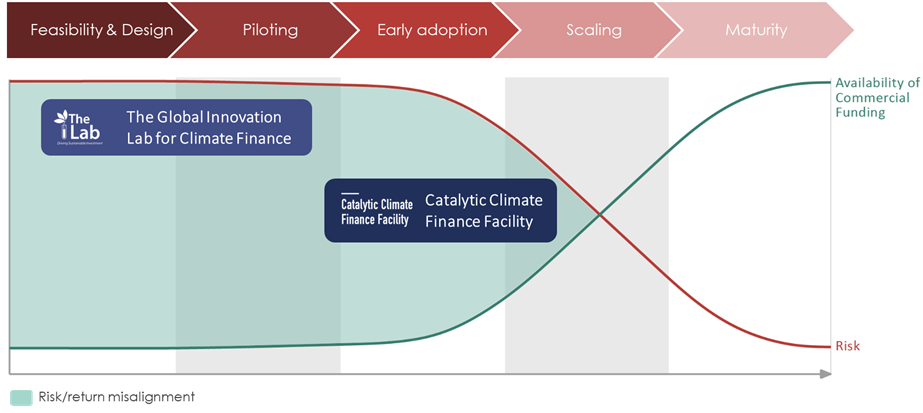

The Climate Policy Initiative (CPI) has thus been established with that observation in mind. As reminded by Carla Orrego, additional private capital is needed to address climate change challenges. However, the lack of private capital today can mostly be explained by the lack of bankable solutions to invest in. Indeed, private investors are first and foremost looking for bankable solutions which are lacking today, creating a pipeline shortage.

In that sense, CPI offers a good example of an organization tackling the pipeline risk. It was developed as an accelerator to help scale climate solutions that leverage several financing mechanisms, of which VCMs. CPI has created 2 facilities combining more than 10 years of experience: the Lab for Climate Finance which selects ideas with potential at an early stage and the Catalytic Climate Finance Facility which focuses on scaling already-tested solutions. To date CPI has supported 68 financial vehicles and catalyzed more than $4 billion in investments.

KSAPA’S PROPOSED METHODOLOGICAL APPROACH

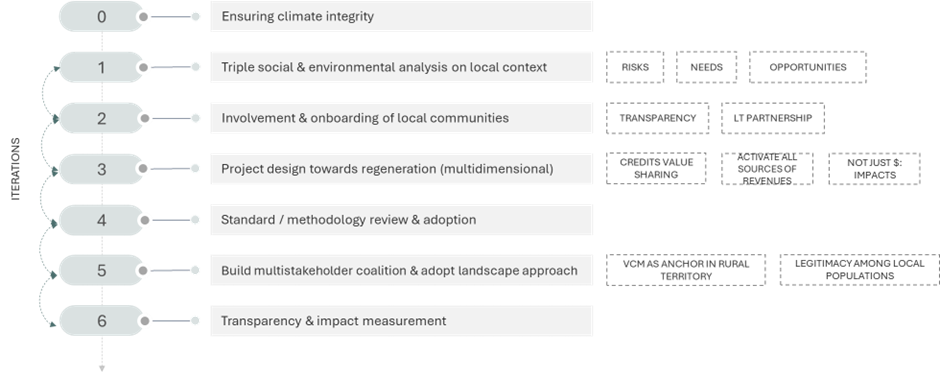

Going over the elements mentioned up to now, one quickly realizes the sheer complexity and diversity of issues to consider and address when developing a voluntary carbon project: ensuring climate integrity, striving for multidimensional positive contributions, consideration of local communities, adequate financing structure…

Navigating across the complex VCM environment, its stakeholders and processes without guidance is difficult for project proponents. Ksapa thus reflected on the different steps and critical elements that every project developer should go through in order to design a truly impactful project. This tentative methodological approach presented below serves as a working proposal that will be enriched by Ksapa’s own experience as well as the feedback from other stakeholders.

The process goes as follows:

- First things first: ensuring climate integrity is key.

- Delving into local context, developers should adopt a 360° approach to assess all the different risks, needs & opportunities in the area: any deforestation risk? Issues with land titles? Crop diversification opportunities? Building upon this careful analysis will help developers design a project that is meaningful with respect to the local context: it takes stock of the risks and tries to address them and it leverages opportunities for the benefit of communities. Through this process, projects become multidimensional and go beyond “climate only”.

- Throughout the process involvement of communities is key: to be able to understand the context, identify risks & opportunities… Long-term partnership is key to anchor VCM in rural territories.

- Project design should build upon 360° analysis to leverage opportunities and address identified risks. Only through this process can project developers leverage every revenue stream possible (on top of carbon finance: off-taking? Diversification for farmers?)

- According to project activities, quantification methodologies shall be selected to maximize carbon benefit while optimizing monitoring efforts for farmers on the ground.

- Developers looking for multidimensional impacts should use VCM project as an anchor in territories, established in the long term, to build upon it and address other existing challenges in the landscape: a multistakeholder coalition will help align actors on a common vision while having different agendas (agriculture, climate, livelihood, deforestation, land rights…).

- Impact measurement is key to cement multistakeholder coalitions around a common agenda and ensure continued support of partners. Transparency about impact is also critical to maintain long-term partnership with local communities.

The key takeaway from this approach is the iterative process it relies upon. Projects can and should always evolve in accordance with the realities of the territories they operate in. Risks, needs and opportunities constantly evolve, and so should voluntary projects.

Conclusion

While VCMs have seen a wave of controversies and criticism in recent years, they are still a nascent market which needs continuous improvement to deliver on its promise. The first challenge is to ensure climate integrity, and most of the debate has been focused on those aspects for now. However, stakeholders should look beyond climate integrity and assess VCMs with respect to their potential to positively contribute not only to climate action but sustainable development as a whole. In that sense, taking stock of the different dimensions a project should consider to be socially & environmentally impactful, Ksapa proposed an iterative methodological approach allowing to design comprehensive projects rooted in field realities.

Adrien is a SUTTI Program Officer. He’s responsible for the development, operational implementation, and monitoring of SUTTI programs. He participates in designing financial structuring schemes leveraging SUTTI’s impacts.

He has previous experiences in various industries, within public, private, and non-profit organizations. Before joining, he was involved in microfinance and social entrepreneurship initiatives in Cambodia and the Philippines, after working for Danone and RATP.

He holds a Master’s in Finance from Paris-Dauphine University, as well as a Master in Management from ESSEC Business School.

He speaks French, English, and Spanish.