his article is part of a series republished via the Council of Business and Society platform.

The EU Green Taxonomy helps investors, companies, issuers and project promoters navigate the transition to a low-carbon, resilient and resource-efficient economy. This new tool helps them identify assets and carry out ESG tagging through a standardized, consistent approach. Ksapa offers a guide to approaching the EU Green Taxonomy and tips to set it in motion.

Principles of the EU Green Taxonomy

The EU Green Taxonomy is one of the most significant developments in sustainable finance. It will doubtlessly have wide-ranging implications for investors and issuers working in the EU and beyond.

Performance Thresholds

This new Taxonomy sets performance thresholds referred to as ‘technical screening criteria’, for economic activities to:

- First, Make a substantive contribution to at least 1 of 6 environmental goals. These range from climate change mitigation to climate change adaptation, sustainable protection of water and marine resources, the circular transition, pollution prevention and control and the protection and restoration of biodiversity and ecosystems;

- Second, do no significant harm (DNSH) to any of the other 5 goals wherever relevant;

- Finally, meet minimum safeguards (e.g. OECD Guidelines on Multinational Enterprises, the UN Guiding Principles on Business and Human Rights, etc.).

These performance thresholds guide companies, project promoters and issuers to tap green financing and improve their environmental performance. It additionally supports them in identifying environmentally-friendly activities. In doing so, it will help to grow low-carbon sectors and decarbonize their carbon-intensive counterparts.

The Green Taxonomy is therefore supportive of the EU’s 2030 climate and energy targets. It likewise shores up the EU Green Deal, which offers a roadmap to guide the European Union towards climate neutrality by 2050. Finally, it offers a new classification system designed to shift investments toward a low-carbon and climate-resilient economy – as opposed to greenwashing.

The Underpinning Taxonomy Regulation

The Taxonomy Regulation (TR) was agreed upon at the political level in December 2019. It creates a legal basis for the Green Taxonomy by setting out its overarching framework and environmental goals. It also issued new legal obligations for financial market participants, large companies, the EU and Member States.

Delegated acts will supplement the TR to explicit detailed technical screening criteria. That way, private players can pinpoint which of their economic activities may be deemed sustainable. As such, it determines whether activities are aligned with the EU Green Taxonomy.

Adapting to the EU Green Taxonomy

By defining screening criteria, the Green Taxonomy developed a list of environmentally sustainable activities. That said, it is neither a rating of “good” or “bad” companies. Nor is it a mandatory list of economic activities to invest in or to divest from. It does, however, aim to provide clear definitions of what constitutes “green” for companies, investors and policy-makers.

The Taxonomy Regulation sets out 3 groups of Green Taxonomy users:

- Financial market participants offering financial products in the EU – including occupational pension providers;

- Large companies already required to publish non-financial disclosures under the Non-Financial Reporting Directive (NFRD);

- The EU and Member States upon setting public measures, standards or labels for green financial products or green (corporate) bonds.

New Disclosure Requirements in the EU Taxonomy

The final Taxonomy Regulation introduces a new disclosure requirement for companies already required to provide a non-financial statement under the NFRD.

While national implementation varies, the NFRD covers, at minimum, large public-interest companies with more than 500 employees. This includes listed companies, banks and insurance companies. Any company subject to this requirement will have to describe how and to what extent their activities are Taxonomy-aligned.

For instance, non-financial corporate disclosures must now include:

- The proportion of their turnover aligned with the Taxonomy;

- Their Capex and, if relevant, Opex aligned with the Taxonomy

Such disclosures are to be embedded in non-financial statements, included in annual reports or standalone sustainability reports. As a result, these disclosures must be consistent with the climate corporate reporting guidelines released by the EU Commission in 2019 (as an update of the 2017 environmental and social disclosure guidelines).

Complying with Minimum Safeguards

Companies and other issuers disclosing against the EU Green Taxonomy will be required to assess their compliance with minimum quantitative and process-based, qualitative criteria. The latter include standards embedded in the OECD Guidelines on Multinational Enterprises (MNEs) and the UN Guiding Principles on Business and Human Rights, with specific reference to the ILO Core Labor Conventions.

Private players will also be expected to assess or check their compliance with the technical screening criteria for avoiding significant harm to environmental objectives. Core regulatory and standards of reference include EU regulations as well as the ISO 31000:2018 Risk Management and ISO 14015:2010 Environmental management guidelines.

Doing Business With the EU Market

Companies based in, doing business with or working with investors in the EU are bound to heed the Green Taxonomy and anticipate major impacts on investments.

The TR is likely to increase investment in activities deemed environmentally sustainable across a range of sectors. This includes (but is not limited to) food and agriculture, construction and real-estate, technologies, capital intensive industries, transport, energy and utilities, consumer good products or financial services. This covers virtually every business line with major impacts on the climate. In other words, the Green Taxonomy is a big deal for any company based in Europe, doing business or investing on the European market.

The EU Taxonomy is the world’s first ever green list certification system.

Late in 2020, the EU and China launched a working group hosted by the International Platform on Sustainable Finance to develop a “common ground taxonomy”. Other markets, including ASEAN, Canada, China, Japan are undergoing different stages of consultation and evaluation to establish their own. Hard to believe Wall Street will keep for long a wait and see position. While the City of London is still grappling with Brexit, such a key financial powerhouse will doubtlessly explore options to align – or at least leverage some of the many nuances offered by the EU Taxonomy.

Next Steps for Implementing the EU Green Taxonomy

To some extent, the Green Taxonomy will no real departure from what leading companies and investors have been doing for years. Still, ongoing standardizing efforts force companies and investors to clarify their strategy and position.

Companies and Investors Pressured to Clarify Climate Targets and Just Transition Strategies

With the new Green Taxonomy, companies working with European investors will have to assess which of their economic activities are considered environmentally sustainable, based on the established criteria. This can help them clarify a number of board discussions on climate – and structure they fiduciary responsibility accordingly.

Companies can then consider the appropriate interventions to reduce the potential regulatory and financial risks linked to activities outside the scope of the Green Taxonomy. From there, they may also explore opportunities associated with adjusting activities to gain Taxonomy alignment.

A 5-Step Process to Align with the Green Taxonomy

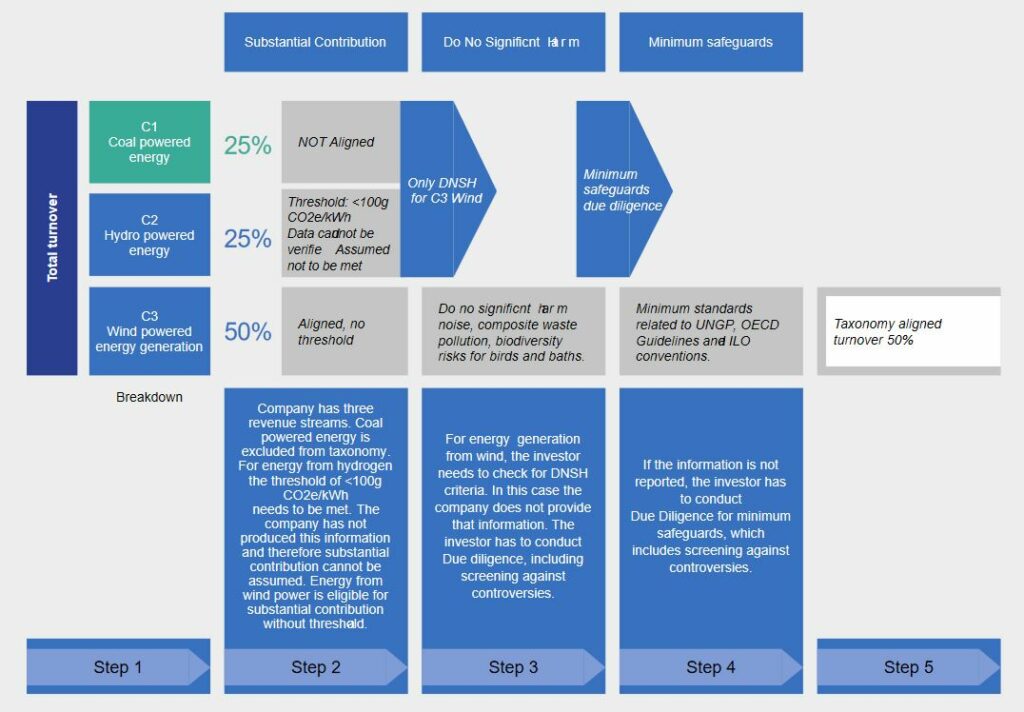

The Technical Expert Group on Sustainable Finance recommended a 5-step process.

By combining its in-house expertise, methodologies and tools, Ksapa can help organizations comply with all 5 phases. Here is an example of how this applies to investments in companies:

- First, identify activities – conducted by the company or issuer, as well as those covered by financial products (e.g., projects, use of proceeds) – potentially aligned with the Green Taxonomy. Consider; too, which of its 6 environmental objective(s) they address.

- For each activity, verify whether the company or issuer meets the relevant screening criteria – e.g. electricity generation below 100 gCO2e/kWh.

- Ensure all DNSH criteria are met by the issuer. Investors using the Green Taxonomy will most likely use a due diligence-type process to review the performance of underlying investees. They may rely on the legal eligibility disclosures of these investees to that end.

- Conduct due diligence to avoid any violation of the social minimum safeguards stipulated in the Taxonomy Regulation.

- Calculate your investments’ alignment with the Green Taxonomy and prepare disclosures at investment product level.

Conclusion

Globally, there has been increasing demand for corporate ESG disclosure. On top of climate-specific disclosures, the Task Force on Climate-related Financial Disclosures gained momentum in recent years. Indeed investors are increasingly seeking better data – both more consistent and comparable.

The EU Green Taxonomy offers granular definitions of “green” activities are. The corresponding screening criteria are useful tools to lend financial institutions and investors greater clarity and certainty on the environmental sustainability of different types of investments.

Ksapa works closely with a global community of investors and large companies to build more resilient and inclusive business models. We therefore welcome the EU Taxonomy, as it drives clarity and compliance. This eventually enables leaders to push further – and laggards to face their responsibilities. We stand at the ready to share our expertise, credentials and methodologies, to help you effectively navigate the resulting complexity.

Author of several books and resources on business, sustainability and responsibility. Working with top decision makers pursuing transformational changes for their organizations, leaders and industries. Working with executives improving resilience and competitiveness of their company and products given their climate and human right business agendas. Connect with Farid Baddache on Twitter at @Fbaddache.