The Omnibus I legislative package linked to the European Green Deal aims at simplifying environmental and social standards. Even with ambitions being scaled back, one reality remains unchanged: overlooking a solid CSR policy is no longer an option. ESG risk management continues to be a key lever for maintaining competitiveness, reassuring investors and stakeholders, and ensuring resilience in a context marked by growing systemic risks. Why is it still necessary to keep investing human and financial capital for a more sustainable performance — regardless of whether the regulatory framework is weakened or not?

Regulatory Simplifications and Impact on CSRD and CS3D

In February 2025, the European Commission published a draft legislative package aimed at simplifying EU regulations (the “Omnibus” legislation). The stated objective is to ease the regulatory burden on companies and simplify sustainability reporting requirements, with a target of reducing administrative costs by 25% for large companies and 35% for SMEs.

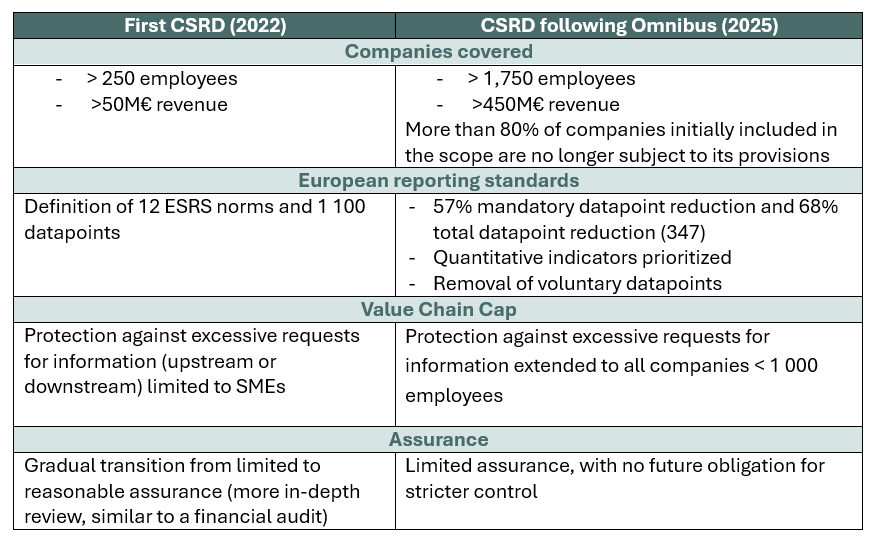

CSRD Following the Omnibus

The Corporate Sustainability Reporting Directive (CSRD) is one of the key components of the European Green Deal. Its purpose is to enhance transparency regarding companies’ ESG impacts across their entire value chain. While its application began for the 2024 financial year, the adoption of the Omnibus legislative package introduces significant changes. The main adjustments concern the scope of companies covered, the level of reporting, and modalities of verification:

Thus, companies that no longer meet the eligibility criteria under the revised thresholds will be able to publish ESG information on a voluntary basis through a simplified reporting standard, the VSME (Voluntary Small and Medium Enterprises) standard, developed by EFRAG for SMEs.

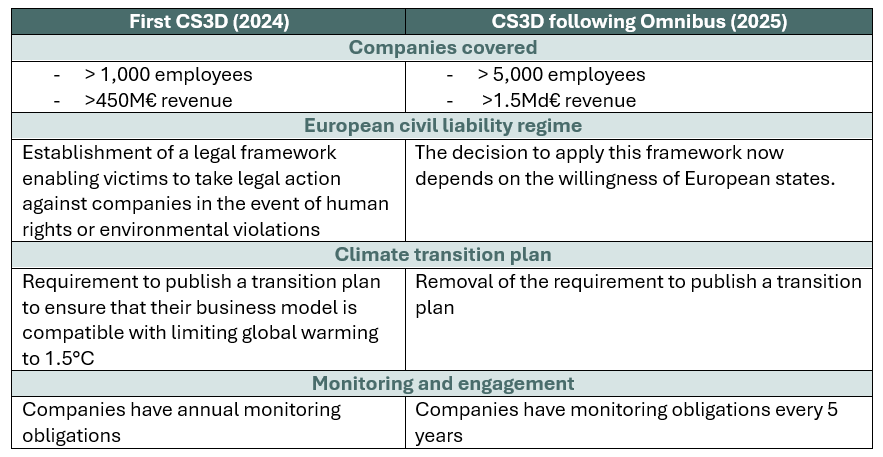

CS3D Following the Omnibus

Adopted in 2024, the CS3D originally required companies to identify, prevent, and mitigate ESG-related risks within their operations. The CS3D has also been significantly weakened and reshaped by the Omnibus package:

Beyond Compliance: 4 Reasons To Maintain Investments for a Sustainable Performance

Even though the regulatory scope of the CSRD and CS3D has been reduced, the efforts already undertaken by companies to improve ESG risk management remain strategic. The benefits of ESG assessment, monitoring, and mitigation go far beyond regulatory compliance. They drive competitiveness, resilience, and effective risk management.

A Lasting Competitive Advantage

While implementing a robust ESG strategy helps companies better manage their external reporting, it is first and foremost an internal lever for managing strategic and operational risks throughout the entire value chain. In a context marked by geopolitical instability and growing systemic risks linked to climate change, having access to reliable and accessible data is essential to:

- Secure supply chains,

- Diversify sourcing,

- Anticipate crises likely to disrupt operations.

In this sense, ESG transparency should no longer be viewed as a financial burden, but as a long-term investment. 81% of sustainability leaders see it as a driver of innovation and a competitive advantage. Even before informing external reporting, ESG data collection provides internal insights into operational vulnerabilities.

A Growing Reputational Issue

Corporate social responsibility has become a central criterion for assessing a company’s reputational performance. Scandals involving working conditions or unsustainable resource exploitation demonstrate that a lack of visibility and control over the value chain can lead to severe reputational, financial, and economic consequences:

- The collapse of the Rana Plaza building in Bangladesh in 2013 caused more than 1,100 deaths and revealed the scale of risks linked to inadequate oversight in textile supply chains.

- In 2020, Boohoo lost more than 45% of its market value after severe labor rights violations within its UK supply chain were exposed during the Covid-19 pandemic.

- Corporate climate responsibility has also entered a new phase. A landmark lawsuit in Switzerland brought by four residents of the Indonesian island of Pari against cement giant Holcim illustrates this shift.

These events show that ESG vigilance is now inseparable from a company’s reputational protection.

A Global Wave of Increasing Requirements

While the EU is easing certain regulatory requirements, the global trajectory is clear: transparency and due diligence are strengthening worldwide, progressively requiring more robust risk management systems:

- The EUDR will require automated and documented due diligence demonstrating — supported by geospatial data — that every shipment of soy, cocoa, or timber is free from post-2020 deforestation.

- The Uyghur Forced Labor Prevention Act (UFLPA) requires enhanced supply chain visibility and due diligence, and mandates remediation plans in cases of confirmed violations.

- The upcoming EU Forced Labor Regulation will impose strengthened controls, and increased prevention and mitigation measures across the entire value chain.

Better Market Access

The quality of a company’s non-financial information can directly facilitate access to financing. Investors increasingly integrate risk management through ESG scores in their decision-making processes. The growing influence of extra-financial rating agencies (MSCI, Sustainalytics, ISS-ESG, S&P Global Ratings, etc.) shows that having ESG data that is:

- Reliable,

- Auditable,

- Aligned with a credible medium- to long-term strategy

is a real advantage for accessing capital. This trend is already visible in investment decisions. According to a PwC survey, 69% of investors prioritize ESG criteria in their strategy, while 56% have already withdrawn from a deal due to ESG concerns at least once within a 12-month period.

The Ksapa Advantage

Even when certain standards are renegotiated or diluted, the underlying trend remains the same: more transparency, more accountability, and more remediation. Companies that anticipate these regulatory requirements will strengthen their competitive position. It is in this context that Ksapa delivers significant added value.

Strategic Expertise

Our approach transforms regulatory frameworks into strategic management levers by integrating:

- Compliance requirements,

- Operational imperatives,

- Economic performance objectives.

We help organizations build robust ESG reporting and due diligence systems that evolve with regulations while delivering tangible benefits, such as improved risk management, optimized processes, and enhanced credibility with financial partners.

Effective Operational Solutions

Our advisory services go beyond mere regulatory compliance in human rights. They position your company as a sustainability leader, creating positive impact while supporting long-term growth. Our offerings cover the full ESG maturity cycle:

- Comprehensive assessment and human rights risk analysis

- Strategic integration of ESG topics into corporate operations

- Full risk mitigation and impact management

- Regulatory excellence and adoption of best practices

Our expertise spans all industries and international markets. We understand agricultural supply chains, navigate the complex challenges of tech and manufacturing, and support the evaluation of mining or strategic infrastructure assets across territories.

Ksapa combines diverse skill sets: sustainability specialists work alongside supply chain experts, while human rights practitioners collaborate with financial analysts.

Our case studies demonstrate measurable results. We have supported multinational corporations in transforming supply chain management and helped mid-sized companies build robust due diligence systems. These achievements are tangible, measurable, and valued by financial and commercial partners alike.

Contact us: contact@ksapa.org

Credit: Pexel

Dana est membre de l'équipe conseil en tant que consultant junior et renforcer l'équipe sur les sujets de droits de l'homme et durabilité. Passionnée par ces enjeux, Dana a précédemment travaillé chez Altai Consulting sur des questions de durabilité et de société en Afrique. Diplômée d'un Master en commerce international à HEC Paris, Dana parle français et anglais.