Businesses face trade wars, geopolitical tensions & slow growth. How to build resilient operations through strategic risk management?

State of Sustained Uncertainty for Business

Dramatic Shift of the Economic and Geopolitical Landscape in a Few Months

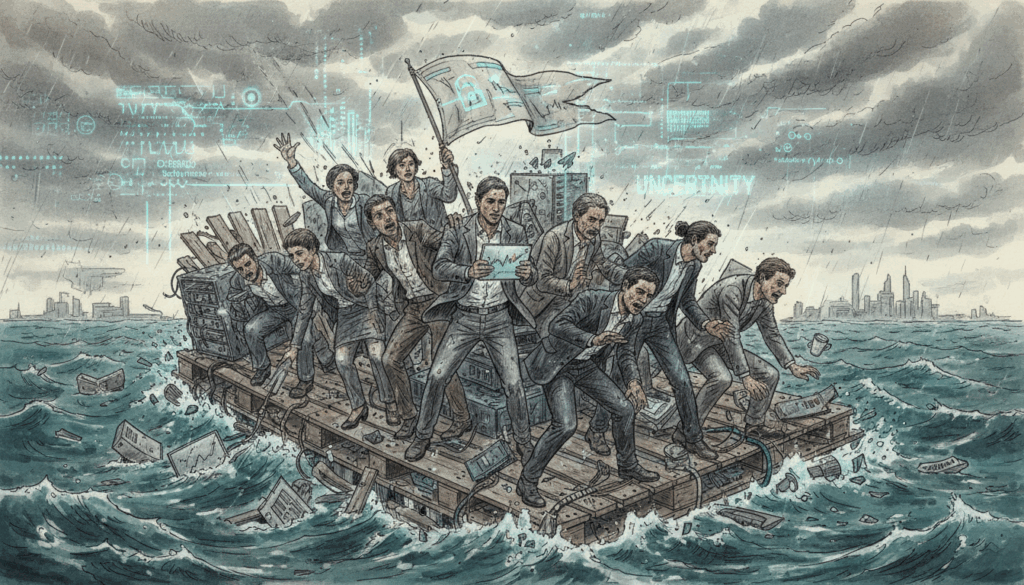

European businesses today find themselves sailing through remarkably foggy waters. The economic and geopolitical landscape has shifted dramatically, creating what can only be described as a state of sustained uncertainty—a blur where traditional forecasting models struggle and conventional strategic planning falls short. From US trade policy whiplash to escalating security concerns and persistent conflicts, the continent faces a confluence of challenges that demand a fundamental rethinking of how companies build resilience and sustain operations.

Within This Blur Lies an Opportunity

While Europe navigates these turbulent conditions, businesses that can identify what’s truly here to stay—the foundational elements that will persist regardless of which political winds blow or which trade barriers rise—will position themselves not merely to survive, but to thrive. The question isn’t whether to adapt, but how to build robust, long-term blocks of resilience that can withstand whatever comes next. This means returning to basics without abandoning sustainability considerations, and understanding that managing risks and costs intelligently has never been more critical to competitive advantage.

The Economic Reality: Europe in the Blur

Significant Blow to Export Growth

Europe’s growth outlook has dimmed considerably as rapid changes in US trade policy create cascading effects throughout the continent. The imposition of blanket 15% US import tariffs on European goods—including critical sectors like automotive, semiconductors, and pharmaceuticals—alongside 50% tariffs on metals, has dealt a significant blow to export growth. Germany, Europe’s manufacturing powerhouse, stands as the worst affected economy, struggling to maintain momentum in its traditionally robust export sectors.

The initial response to these tariff threats was predictable: a front-loading trend in early 2025 saw businesses scrambling to ship goods before penalties took effect. But that temporary boost has now evaporated, leaving European exporters to confront the full reality of a more protectionist American market. The geopolitical risk and policy uncertainty weighing on the world economy have pushed global growth forecasts to an annual average of just 2.5% for 2025-26—the slowest pace since the pandemic, despite upward revisions reflecting resilience in some regions.

What makes this environment particularly challenging is its unpredictability. The Trump administration’s approach to rebalancing US economic and security relations, while aimed at American interests, strains traditional alliances and drives economic realignment in ways that are difficult to forecast. Central banks face the daunting task of deciphering inflation trends when tariff applications remain unpredictable, complicating monetary policy decisions even as interest rates are expected to continue falling.

Consumer-Facing Sectors May Find Pockets of Opportunity

However, not everything points downward. Consumer spending in Europe is projected to strengthen in 2026, supported by lower inflation and falling interest rates. Multiple factors—including those same US tariffs, a strong euro, and rising Chinese imports—are contributing to disinflation. This suggests that while the business-to-business landscape remains challenged, consumer-facing sectors may find pockets of opportunity. The key is understanding which signals to follow and which represent temporary noise in an otherwise chaotic environment.

Geopolitical Tensions: The Security Premium on Business

Heightened Security Concerns Unthinkable Just a Few Years Ago

Beyond trade policy, European businesses must now factor in heightened security concerns that seemed unthinkable just a few years ago. Despite US efforts to broker peace, a resolution to the Ukraine conflict remains distant, and the risk of future Russian aggression against Europe is being taken increasingly seriously across the continent. This isn’t merely a diplomatic concern—it’s a business reality that affects supply chain planning, energy security, insurance costs, and investment decisions.

Europe’s response has been to accelerate efforts to develop independent security capabilities, reducing reliance on long-standing US guarantees. This shift carries significant economic implications. European support for Ukraine will intensify in 2026, but against a backdrop of fiscal constraints, aging demographics, and rising populist movements, the costs of this commitment are becoming increasingly divisive. Businesses operating in Europe must navigate not just the direct impacts of conflict and instability, but also the secondary effects of defense spending crowding out other priorities and political fragmentation complicating decision-making.

Maximum Agility Planning for Business

Meanwhile, conflict risks extend beyond Europe’s eastern borders. Tensions in the Middle East continue to simmer. High risk premia persist across commodity markets, sustaining the possibility of price shocks that could ripple through global supply chains. Geopolitical brinkmanship has become a defining feature of the global landscape, requiring businesses to maintain scenario planning capabilities that account for sudden shifts in access to resources, transportation routes, and markets.

This environment of sustained geopolitical tension fundamentally changes the calculus of where to operate, how to structure supply chains, and which partnerships to prioritize. The old assumption that geopolitical risk was something that affected “other” regions but left Europe relatively stable no longer holds. European businesses must now price in security considerations as a core component of strategic planning, recognizing that the risk of policy missteps remains high as rapid changes outpace institutional capacity to adapt.

Back to Basics: Sustainability as Risk Management

Sustainability is Fundamentally About Understanding Risks and Managing Costs Effectively

In times of profound uncertainty, there’s a natural instinct to strip away anything that seems like an “add-on” and focus exclusively on immediate survival. But this instinct, however understandable, misses a crucial point: properly framed, sustainability isn’t a luxury consideration or an ethical add-on—it’s fundamentally about understanding risks and managing costs effectively.

- Consider supply chain resilience through a sustainability lens. Companies that have mapped their tier-two and tier-three suppliers, assessed water stress in manufacturing regions, or evaluated energy security at production facilities aren’t just checking ESG boxes—they’re building the visibility needed to anticipate disruptions before they cascade through their operations. When geopolitical tensions threaten access to critical materials or tariffs reshape trade flows, businesses with this deeper understanding can pivot faster and more cost-effectively than those flying blind.

- Similarly, energy transition investments that might have been justified primarily on emissions reduction grounds now carry a different strategic value. As Europe reduces energy dependence on unstable or adversarial regions, businesses that have already diversified their energy sources or improved efficiency find themselves with lower cost structures and greater operational flexibility. What was sustainability has become resilience; what was risk management has become competitive advantage.

Integrated Thinking Needed

The blur that European businesses navigate today demands this kind of integrated thinking. Getting back to basics doesn’t mean abandoning sustainability considerations—it means recognizing that the most fundamental basics of business success have always included understanding and managing risks that others overlook. In an environment where commodity price shocks remain likely, where supply routes can shift due to conflict, and where regulatory environments respond to security concerns as much as market forces, the companies that survive and thrive will be those that see sustainability not as a separate initiative but as core to operational resilience.

This reframing matters because it cuts through the false choice between short-term survival and long-term responsibility. Smart risk management in today’s environment necessarily includes climate resilience, supply chain transparency, stakeholder engagement, and resource efficiency. These aren’t departures from business fundamentals—they are business fundamentals, perhaps more clearly now than ever before.

Conclusion: Gaining Clarity in the Blur

Europe may be in the blur, but businesses don’t have to navigate it blindly. The challenges facing the continent—from trade protectionism to geopolitical realignment, from slow growth to security concerns—are real and significant. Yet within this uncertainty lie the building blocks of genuine resilience: clear-eyed risk assessment, integrated sustainability thinking, and strategic positioning based on what’s truly here to stay rather than what’s merely making headlines.

The companies that will emerge stronger from this period won’t be those that simply hunker down or those that ignore the changed landscape. They’ll be the ones that strategically build resilience where it matters most—in supply chains that can flex with geopolitical shifts, in operations that account for both traditional and emerging risks, and in cost structures that reflect the real economics of a world where security, sustainability, and profitability are increasingly inseparable.

This is where Ksapa comes in. Our expertise lies precisely in helping businesses gain the clarity needed to build robust, long-term resilience in blur market contexts. Whether you’re reassessing supply chain configurations, integrating sustainability into risk management frameworks, or developing strategies to navigate Europe’s evolving operational landscape, Ksapa provides the strategic insight and practical support to move forward with confidence.

Don’t let the blur become paralysis. Connect with Ksapa today to strategize your path through uncertainty and identify where to build the resilient business foundations that will carry you through whatever comes next. In a world of sustained ambiguity, clarity is the ultimate competitive advantage—and it starts with the conversation you’re ready to have now.

Président et Cofondateur. Auteur de différents ouvrages sur les questions de RSE et développement durable. Expert international reconnu, Farid Baddache travaille à l’intégration des questions de droits de l’Homme et de climat comme leviers de résilience et de compétitivité des entreprises. Restez connectés avec Farid Baddache sur Twitter @Fbaddache.