ESG faces mounting criticism, but the solution isn’t abandonment—it’s smarter investment. Learn how Total Cost of Ownership thinking separates transformative value from compliance theater

Category Archives: Sustainable Finance & ESG

Sustainable investment, ESG strategy

China releases Climate Standard No. 1, operationalizing CSDS framework with ISSB alignment and enhanced impact disclosure.

Explore how AI transformation, geopolitical chaos, and environmental crises demand ethical leadership in 2026

Explore how AI testing, geopolitical uncertainty, and environmental crises reshape business strategy in 2026. Expert insights on resilience.

Discover how CSDDD reshapes corporate due diligence, with new scope, enforcement rules, and strategic implications for multinationals.

Paris Agreement + 10 shows commitment gaps. Corporations need action partners for geopolitical uncertainty and climate adaptation strategies.

While the Omnibus Directive scales back European ambitions, implementing ESG risk management remains essential.

In light of the COP30 outcomes on carbon markets, trade, agriculture, and just transition, companies urgently need to transform their value chains themselves. Possible solutions.?

With COP 30 SSP3-7.0 scenario amid fragmented cooperation, businesses must lead climate adaptation. Ksapa supports just transition at scale.

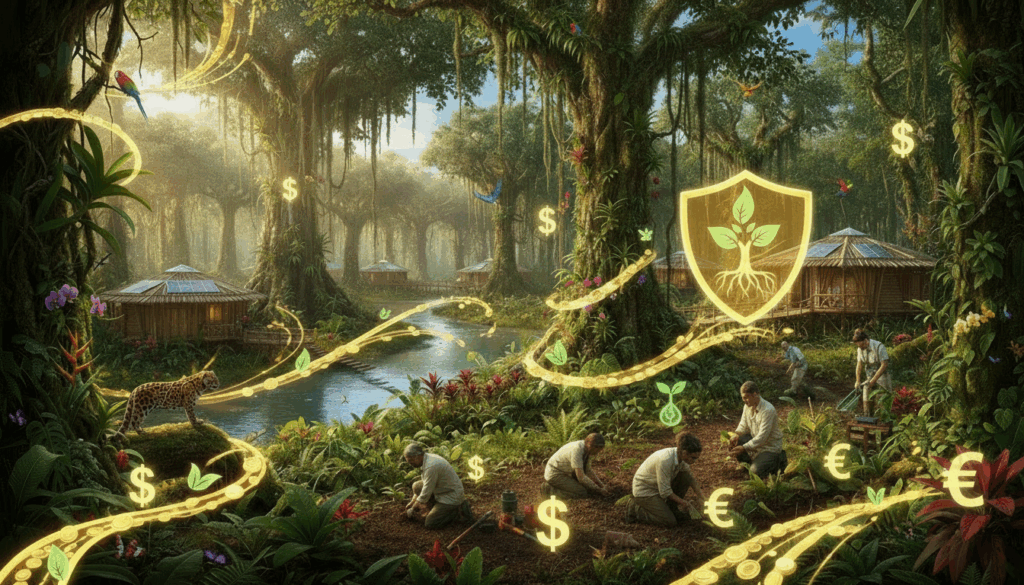

Brazil’s $125B Tropical Forest Forever fund promises to protect rainforests. But does it prioritize profits over planet?