Agriculture as a Lever for Resilience and Climate Change Adaptation in Africa

In Sub-Saharan Africa, the World Bank estimated in 2016 that approximately 82% of those considered extremely poor lived in rural areas, and 76% of them were employed in agriculture (compared to 65% globally), with 41% having no access to formal education.

Financial inclusion of agricultural cooperatives & SMEs in Africa is crucial to improve the living conditions of the most vulnerable populations in the continent, but it remains largely underfunded to meet the existing needs and challenges.

To support a just transition on the continent, the African Development Bank estimates the financing need at about $2.7 trillion by 2030 – roughly $400 billion per year – while only $300 billion annually was committed at the COP in Baku, Azerbaijan, in late November 2024.

There is a shared and clear consensus among stakeholders: agriculture, particularly smallholder farming, is severely underfunded.

Financial Inclusion of Agricultural Cooperatives & SMEs in Africa

Agricultural SMEs: Needs & Financing Gap

There are an estimated 130,000 agricultural SMEs in Sub-Saharan Africa with an annual investment need of $90 billion. These SMEs include micro, small, and medium enterprises involved in processing, transportation, or storage (excluding agricultural cooperatives).

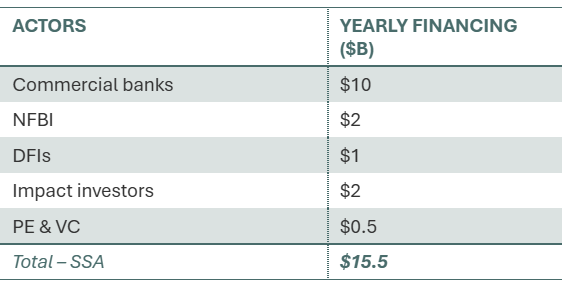

Currently, only $15.5 billion is allocated annually to these actors. Commercial banks remain the primary source of financing (66%), estimated at $10 billion per year, representing just 11% of the total need.

Source: ISF Advisors, 2022: AgriSME Finance, State of the Sector Report

Agricultural SMEs currently face an annual financing gap of $74.5 billion (83%), with average needs of around $700K per SME.

Farmer Organizations: An Exacerbated Financing Gap

Beyond SMEs, the upstream agricultural sector consists of independent smallholders or those organized into various types of farmer organizations, such as cooperatives or farmer groups.

Smallholder farms represent more than 80% of global farms and are key to agricultural transition – particularly for a just transition. About 2 billion people live on roughly 500 million small farms that underpin global value chains and produce 80% of the food consumed in Asia and Sub-Saharan Africa.

For smallholders, the unmet demand for financial services is estimated at $170 billion annually. For long-term financing needs, 98% go unmet. On average, loans secured by farmer organizations are $13K over 12 months, and only 13% receive loans above $70K.

The demand for financial services from farmer organizations arises from several needs:

- Working capital for seasonal production

- Technical assistance to adopt practices enhancing climate resilience and productivity

- Medium and long-term financing for infrastructure investment

- Risk management tools, such as climate insurance

Financial Inclusion Market Status in Africa

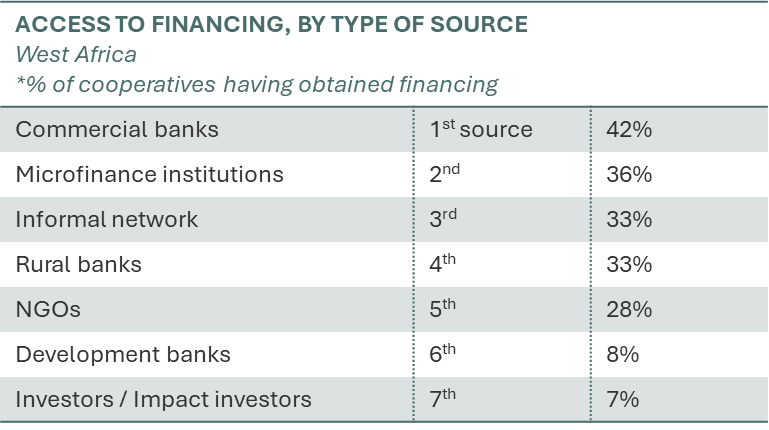

Several actor types are active in the financial inclusion market in Sub-Saharan Africa:

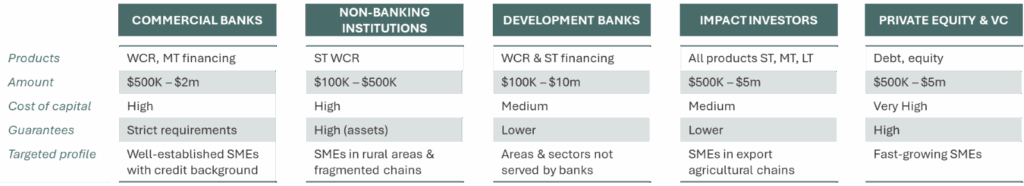

- Commercial banks: traditional financial institutions holding banking licenses and acting as the primary (often only) source of agri-SME financing.

- Non-bank financial institutions: financial entities with limited or no banking licenses and less oversight.

- Development banks: state-owned or funded intermediaries providing subsidized short- and long-term credit to promote economic development.

- Impact investors: funds providing equity and/or debt to agri-SMEs, aiming for at least capital preservation and a positive social, economic, and/or environmental impact.

- Private equity: capital investment and venture funds targeting private companies, often incorporating impact goals by operating in Sub-Saharan Africa or Southeast Asia.

These actors offer financial products based on their capacity, risk appetite, and return expectations. Key characteristics:

- Primarily short-term financing (working capital)

- High amounts (near $1M)

- Strict collateral requirements

However, new actors – “social lenders” – have emerged, focusing on financial inclusion for rural communities in developing countries. Their offers are more aligned with agricultural SMEs and farmer organizations:

- Typical loan amounts around $500K

- Loan maturities of more than 3 years

- Low or no collateral requirements

Some also offer equity investments, enabling long-term structural support for key sector actors and strengthening their balance sheets while leveraging expert partnerships.

Barriers to Market Development

Despite new entrants, several obstacles hinder market development.

On the demand side:

- High interest rates due to local/global instability, commodity price volatility, and climate risk, making investment in development and equipment structurally difficult

- Lack of sufficient collateral

- Complex, unsuitable procedures and high costs in a context of low formalization and weak governance

- Geographic remoteness and lack of infrastructure (training, digital tools, markets, etc.)

On the supply side:

- Risk profile and immaturity of organizations: unstable income, political/regulatory risks, fragmented value chains, lack of financial literacy

- High transaction costs for funders preferring deals over $1M

- Lack of risk-tolerant capital targeting agri-SMEs and farmer organizations; most funders focus on dynamic SMEs with export outlets

Innovation Levers to Accelerate Financial Inclusion of Agricultural Cooperatives & SMEs in Africa

As seen, financial actors adopt diverse strategies with limited impact:

- Too narrow (targeting only dynamic SMEs)

- Too broad (with no evaluation of producer profiles)

Studies, such as by MIT’s Poverty Action Lab (led by Nobel laureates Esther Duflo & Abhijit Banerjee), show that effective financial inclusion relies on experienced organizations and community leaders.

Key findings:

- Credit access doubles income impact for entrepreneurs with existing businesses compared to households with no prior experience (study in India)

- Broader economic effects: wage increases, job creation, better poverty reduction when credit targets community leaders vs. distributing small loans widely

Thus, strategies should target:

- High-growth agri-SMEs

- Dynamic farmer organizations led by experienced leaders (rather than broad outreach regardless of producer profiles)

Targeting cooperatives (preferably) and SMEs (by sector) boosts their capacity to act as local value creation vectors with ripple effects on surrounding populations.

Risk-sharing strategies (de-risking) involving donors, impact investors, and institutions are also key – they lower risk for banks/investors and allow better terms for cooperatives & processing SMEs.

Finally, it is crucial to address value chain fragmentation by aligning mandates under a shared agenda. Agricultural value chains are often fragmented with many intermediaries, each with narrow responsibilities. This limits holistic approaches and overall performance improvement. Integrating all stakeholders – authorities, buyers, NGOs, researchers, universities, experts, solution providers – is vital while respecting their roles and commitments.

Case Study: IREN AGRI Initiative – A Ksapa & Société Générale Partnership

Société Générale and Ksapa partnered to design and deploy affordable financing schemes for farming communities that foster rural value creation, strengthen agricultural value chains, and generate social and environmental impact through multi-stakeholder coalitions including industry and civil society.

Starting in Côte d’Ivoire, this partnership aims to develop solutions combining:

- Technical assistance

- Low-tech digital tools

- Impact finance

These support local and international actors in generating positive social and environmental impact and local value creation.

Ksapa will support medium/long-term financing at the cooperative level through:

- Needs diagnosis at the farmer and cooperative levels

- Prioritization in a transformational investment plan

- Disbursement of medium-term credit (equipment, training, digitalization…)

It will also include long-term impact tracking and value creation for the country and local communities.

Together, Société Générale and Ksapa envision multi-year investment credit schemes involving entire value chains. The goal: establish a scalable financial and operational model for replication across other agricultural value chains and geographies in West Africa.

Adrien is a SUTTI Program Officer. He’s responsible for the development, operational implementation, and monitoring of SUTTI programs. He participates in designing financial structuring schemes leveraging SUTTI’s impacts.

He has previous experiences in various industries, within public, private, and non-profit organizations. Before joining, he was involved in microfinance and social entrepreneurship initiatives in Cambodia and the Philippines, after working for Danone and RATP.

He holds a Master’s in Finance from Paris-Dauphine University, as well as a Master in Management from ESSEC Business School.

He speaks French, English, and Spanish.