Ksapa recently organized a webinar on key trends, challenges and best practices in sustainable finance. We invited Maha Keramane, Microfinance and Social Business Director for Europe at BNP Paribas and Etienne Barel, Deputy General Manager of the French Banking Federation.

Key Trends in Sustainable Finance

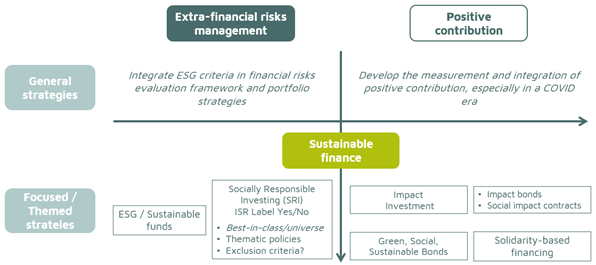

Sustainable finance strategies hinge on two key concepts. One the one hand, managing non-financial risks. On the other, positive contribution relative to socio-environmental issues. That said, risks only remain non-financial for so long. They ultimately give rise to tangible consequences.

These strategies also differ in impact. Prioritizing ESG performance indeed helps organizations minimize risks for their investment portfolios. Through responsible business conduct, they shore up investment strategies. That is particularly true of ESG or SRI-labeled funds. Meanwhile, positive contribution strategies such as impact investment, solidarity finance, green bonds or social impact contracts are designed to deliver on sustainable development aspirations. In essence, they exist to address socio-environmental issues.

Addressing the Broad Spectrum of Sustainable Finance

Thinking more proactively, impact may well come to precondition companies’ license to operate as well as the capacity of mainstream strategies to drive actual value creation. With these considerations in mind, we summarized the broad scope of sustainable finance in the scheme below:

The Growing Attractiveness of Sustainable Funds

Recent figures on sustainable funds are fairly self-explanatory. According to Morningstar, the assets under management of listed funds reached $1650bn at the end of 2020. That correspond to a 29% increase, compared to the same time the previous year.

Europe is driving the global market with a total of $1,100 billion in assets under management at the end of 2020, representing more than 80% of global assets. In the United States, the market is also growing, with $51.1 billion raised in 2020. This in fact marks the 5th consecutive annual record. That said, its potential remains fairly underdeveloped, with a limited $230 billion spread over 400 funds, compared to $3,200 billion in Europe. The SRI label is another driving force in the European market, bringing together nearly 204 billion euros in funds, in more than 600 labeled funds.

Sustainable Finance is More Resilient and Outperforms the Competition

The attractivity of sustainable investment products stems from the simple fact they outperfrom conventional products in the long run. They also demonstrate more resilience, with a greater ability to control volatility in times of turbulence such as ours. Indeed, 62% of ESG funds outperformed the market despite the Covid-induced upheaval of March 2020. In more general terms, these funds also offer long-term performance. For example, the S&P 500 portfolio indexed against the SDG outperformed the conventional S&P 500 by 10.4% in the last 6 years.

This superior performance and resilience of ESG products effectively revamps the risk/return ratio. The correlation between financial and ESG performance translates into better risk management. This in turn allows for greater volatility control and the rise of value creation levers in companies’ quest for positive impact. This is all the more essential in the current monetary context, given how structurally low interest rates appear ti automatically increase asset values.

Coupled with the optimal use of value creation levers, sound ESG risk management shores up corporates’ license to operate. It also enhances the value of assets under management. Set against a sustainable strategy, ESG asset performance effectively aligns businesses’ long-term vision of their investments with their daily activities. This in turn helps them match growing societal expectations.

Rethinking the Risk/Return Ratio

This redefined risk/return ratio also correlates non-financial performance with the cost of corporate debt. In other words, ESG top performers borrow for less. MSCI in fact estimates they pay 60 basis points (0.6%) less than unsuccessful companies with comparable balance sheets.

New Innovations Linking Interest Rate and ESG Performance

In addition, new innovations in financial products equate the interest rate of a loan or bond to the ESG performance of the borrowing company, without necessarily conditioning the use of funds on green or social projects. While Sustainability-Linked Loans (SLL) have been around for a few years, Sustainability-linked Bonds (SLB) appeared more recently. Both illustrate the influence of ESG performance on interest rates. Sustainability-Linked Bonds can for instance lower interest rates by as much as 25 to 75 basis points.

Given the broader appeal for financing the global sustainable transition, these instruments have gained popularity in recent years. No less than $137 billion in SLL were granted to issuers in 2019. Amundi furthermore estimates the market for SLB (the first of which was issued in 2019) could reach $10bn by the end of 2020.

Finally, this evolution of ESG strategies has seen the rise of passive management funds, particularly in the United States. Clear winners of 2020, they recorded a 206% growth in global assets under management (compared to 2019). However, ESG investment funds rely on non-financial agencies, whose ratings are not nearly as centralized as those of more conventional rating agencies. This raises the question of an induced delegation of management to ESG rating agencies.

In short, sustainable finance is increasingly attracting funds, owing to its capacity to outperform conventional alternatives, with greater long-term resilience to boot. Various financial innovations have consequently arisen, calling for specific calibration efforts in terms of framing, regulations and operating methods. This emerging investment universe must indeed be framed and gear financing and investments tools towards sustainability goals.

Emerging Challenges in Sustainable Finance

One of the major challenges of sustainable finance is the convergence of financial and non-financial information. There two driving forces in that regard: one regulatory and the other voluntary. Given various laws will more than likely regiment voluntary reporting, we focus here on regulatory pressures.

Streamlining Financial and Non-Financial Disclosures

Among multiple likeminded global initiatives, the Network for Greening the Financial System brings together a group of central banks – which the FED incidentally just joined. Together, these institutions work on key issues such as the role of central banks in relations to climate stress-tests or asset purchasing policies. Similarly, the International Platform on Responsible Finance aligns all regulatory bodies in the EU, Canada, India and China. Finally, the Task Force on Climate-related Financial Disclosure issues recommendations on climate reporting likely to become a regulatory and market standard.

The result is our collective evolution towards three-tiered reporting model. The first level includes socio-environmental indicators common to all industries. The second corresponds to sector-specific indicators. The third is directly related to a company’s specific activities. The resulting non-financial information would appear increasingly holistic. It will indeed not only cover socio-environmental risks linked to corporate activities but also the risks they pose to society and the environment at large. That is what we now refer to as double materiality.

The Race Towards Global Sustainable Finance Standards

The European Union and the United States appear to be racing to develop global sustainable finance standards. In that regard, ESG rating agencies have coalesced under the American banner, though its Sustainable Finance Plan clearly lends the European Union a strategic edge. The latter effectively streamlines the standardization of stock market climate indicators as per the Paris Accord. It also aims to harmonize information for investors, via the EU Sustainable Finance Reporting Directive, slated for 2024. Finally, the Non-Financial Reporting Directive is also being revised this year to eventually streamline non-financial criteria for all businesses. By classifying economic activities, the green taxonomy (scheduled for 2022/2023) would complete the edifice.

Methodologies for Transitioning Towards a Sustainable Finance

Given the nebula of regulatory and science-based initiatives (such as the SBTi or PACTA for cross-portfolio climate scenario analyses), key players seek common methods. As Etienne Barel pointed out, this is particularly true for banks, being the driving force in transitioning the global economy. Aligning banks against a common methodology is logically topmost on the French Banking Federation’s agenda. The strength, efficacy and speed of’ the global financial sector’s implementation of transition programs thus hinges on consensus.

With regards to this transitioning of the global economy, Etienne Barel also stressed the balance to strike between exclusion policies and supporting financial players’ climate transitions. In other words, now is not a time to level entire economic sectors. It instead boils down to ensuring the decarbonized transition of the global economy. The core issue therefore lies in aligning economic players in a logic of low-carbon transitioning rather than excluding them. This should be translated into the European taxonomy, to embed a panel of options ranging from brown to green assets and inclusive of sustainable transition financing. Etienne Barel finally noted the structuring role of the ECB for the banking sector as a whole. It will prove key to enforcing climate stress-tests, as a framework for commercial banks to boost the broader climate transition.

Broadening of Investment Themes

2020 and 2021 also spell out the broadening of investment themes. While climate is key, new concerns have emerged to bear that range from biodiversity loss to social impact. The latter is crucial in the context of the ongoing pandemic and logically gave rise to an accelerated issuance of social bonds. That corresponds to no less than a 376% growth compared to the first half of 2019. While the expansion of investment themes and instruments apparently complexifies the global market, it in fact enriches the offer at hand. Not only that, this evolution is also necessary evolution to meet the financing needs of the 2030 Global Agenda.

Impact, the New Frontier in Sustainable Finance

Impact steps in as the new frontier in sustainable investment. Going one step beyond embedding ESG issues in risk management, impact measurement emphasizes businesses’ positive contribution at the heart of their activities. As such, actual impact demands new business models. The field of assets under impact investing management in fact soared tenfold between 2016 and 2020. The real change, however, lies in broadening this movement, not just in private equity but across the entire listed universe.

To meet this challenge, Maha Keramane described three guiding principles for impact investment– and impact bonds in particular. The first is to align the intentionality of investors with their partnering non-profit or service provider. Only then can robust socio-environmental goals be set (modelled on financial covenants) and linked to penalties and benefits. Finally, ensuring the best possible impact relies on structuring flexible and benevolent governance systems.

New Instruments Fostering Blended Finance

Impact finance is on the rise thanks to new trends in financial instruments – most notably social impact contracts, development impact bonds and blended finance. Now, the goal is to transition from experimentation to widespread practice. With that in mind, Maha Keramane ventured two convictions. First, payment indexed on audited and verified results is preferable to upstream subsidies. Second, greater visibility on core data (such as the yearly cost of an unemployed person for a community, the cost of placing the elderly in retirement homes, etc.) helps demonstrate the benefits of a given impact program. This would entail showcasing clear social advantages for its beneficiaries on the one hand and economic benefits for the broader community on the other.

Whether regulatory, methodological, or thematic, such issues can fall prey to geopolitical and sovereign tensions. The European Union is for instance still grappling with Brexit, just as Asia vies for global control. That said, Etienne Barel and Maha Keramane both agreed the European Union – and France in particular – leads green finance. While this stems from a European tradition of social voluntarism and scientific rigor, it warrants support and activation in daily financial transactions.

Conclusion | 2021 Outlook on Sustainable Finance

Sustainable finance has become increasingly popular in recent years – and none more so than in the face of the Covid-19 pandemic. This goes to show how essential it is to guide financial flows towards achieving the Sustainable Development Goals by 2030. That in itself will not suffice, however. We need to go beyond currently prevalent risk management measures and instead focus on positive contribution schemes. In other words, we as a collective, need to place sustainability at the heart of our business models, for companies as well as the global banking system.

To that end, we at Ksapa emphasize greater dialog between banks and beneficiaries, across socio-environmental as well as financing issues. Encouragingly, blended and impact finance schemes allow investors to be remunerated for the risk they take. We expect these mechanisms to allow available resources to be redirected towards general interest issues.

Adrien is a SUTTI Program Officer. He’s responsible for the development, operational implementation, and monitoring of SUTTI programs. He participates in designing financial structuring schemes leveraging SUTTI’s impacts.

He has previous experiences in various industries, within public, private, and non-profit organizations. Before joining, he was involved in microfinance and social entrepreneurship initiatives in Cambodia and the Philippines, after working for Danone and RATP.

He holds a Master’s in Finance from Paris-Dauphine University, as well as a Master in Management from ESSEC Business School.

He speaks French, English, and Spanish.