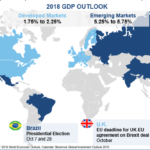

In the early 2010’s it was impossible for a company to offer a development strategy without massive investments in emerging countries such as Brazil, India, Indonesia, emerging countries in Africa and of course China. At the dawn of the next decade, it is urgent to review positions and better balance investments and development projects while maintaining a solid foothold in the old European economies. Comparing the robustness of European economic fundamentals with the major challenges facing emerging economies between now and 2030, Europe has certainly not said its last word…

Many Emerging Economies Have Lacked Clear-cut Capacity to Foster Sustainable Development

I was in Berlin last week to meet with federal public authorities, foundations and German companies. The same applies to everyone: things are not going well enough in Europe, and the Germans, alone, will not get anywhere. Interesting. I thought the Germans had a little more morale than the French and the Yellow Vests, the English and their Brexit. This is not the case.

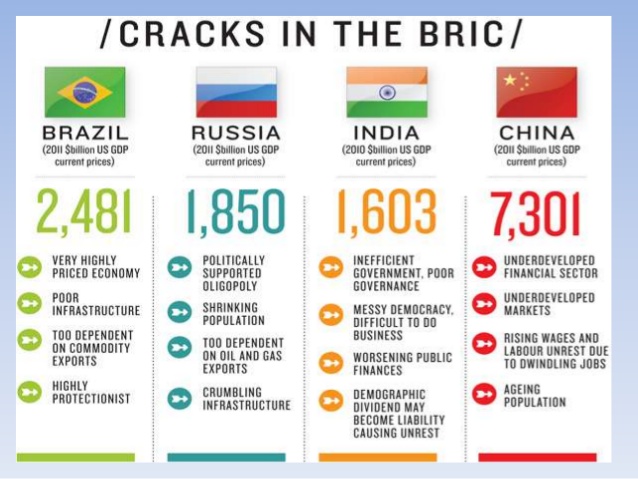

In various emerging countries, after a decade of capital attraction driven by various pharaonic projects, the backlash is severe. Brazil is undoubtedly the most striking example, going from the euphoria of the preparation of the World Cup and Olympic Games in early 2010 to the deep crisis that put almost all political staff and many economic decision-makers in prison for corruption 8 years later. There is the world of the “depressive developed leaders” who coexists with the world of the “depressed emerging”. In the meantime, the temptation to bury Western economies will have been great and some will have even already predicted a permanent collapse of these “old economies”. What turn was missed to lack clarity on the analysis? Who will get the first out of his slump?

Using ESG Criteria in Investment Decisions as a Crystal Ball to Gain Perspective

I was invited to speak about Corporate Social Responsibility (CSR) in the Middle East recently during a discussion with various experts (investors, lawyers, companies). The focus was on the Persian Gulf countries in the midst of an economic boom. A simple observation: GDP does not do everything. From an environmental and social perspective, we see countries facing major challenges that leave us in doubt. A few examples:

- No water. Water is life. For the first time in the human era, we are witnessing the emergence of a city of rapid growth and development without water! Indeed, according to Fahad Al-Attiya, President of Qatar’s National Food Security Programme, the country has only 2 days of water supply and desalinates the sea by burning an astronomical amount of oil. An effective short-term solution when the reserves are large, but the limits are obvious. Domestic gas consumption is growing by 40% and oil by 205% per year. The Emirate emits 60 tonnes of CO2 per year and per inhabitant. Disproportionate figures that reveal an unsustainable position in the long term. At this rate, Qatar will not only have to write off its energy exports, but more importantly, will be unable to provide for itself.

- Time bomb demographic. The unemployment rate in the region is very high (30 to 40% if we restrict the unemployment rate to Saudi Arabians in Saudi Arabia). The creation of public service jobs coupled with a lack of interest in jobs in productive economic functions creates a system in a rush forward, in which states are forced to prioritise public spending over investment to manage the post-oil era. While the monarchies of the Persian Gulf may seem to be an isolated and unique case, this is not the case and the same pattern applies to other emerging market economies. Whether in India, Brazil or Russia, the problems differ, but the common denominator remains an often incompressible structural dysfunction: for example, the lack of skilled labour in Brazil and high levels of corruption make it a risky destination for infrastructure investment. The level of pollution in Beijing or New Delhi is such that the city’s attractiveness is limited, making international investment difficult.

It does not require a crystal ball to question the sustainability of the development of these economies, to temper enthusiasm, and to analyze seriously the investments made in these economies. The use of Environmental, Social and Governance (ESG) criteria allows for contextual elements to be taken into account to better identify risks and calibrate the relevance of investments. This is an opportunity to strengthen the vigilance points both in the selection of projects and in the conduct of negotiations with partners or in operational implementation.

Old Europe Basically Has Stronger Foundations

In contrast, while France and Europe in general is caught in a dangerous spiral combining zero sustainable growth, persistent high unemployment and unsustainable environmental degradation, it is still based on fundamentals that represent precious assets to be weighed against a changing world and the harsh economic competition that is emerging day after day:

- A very well educated population.

- Institutions that do not function that badly (police, justice).

- Quality infrastructure.

- An ever-increasing consensus that ecological imperatives must be factorized in new growth and development drivers

Admittedly, we must look at European economies that are unable to reform themselves, create jobs and secure a future for their young people, in a sober and unsatisfied way. But instead of looking at this with defeatism, we must also weigh the assets at hand and on which to build a sustainable and competitive development model.

Président et Cofondateur. Auteur de différents ouvrages sur les questions de RSE et développement durable. Expert international reconnu, Farid Baddache travaille à l’intégration des questions de droits de l’Homme et de climat comme leviers de résilience et de compétitivité des entreprises. Restez connectés avec Farid Baddache sur Twitter @Fbaddache.