Once the potentially material sustainability issues and their respective IROs are identified, how to determine the relative importance of each of them using the CSRD guidance? First step is to structure IROs and input a double materiality assessment tool. Companies are held accountable for their double materiality and related implications for their strategies. Therefore, tracing each impact, risk and opportunity with its analysis and results is critical. Learning from our experience conducting such double materiality with a diversity of companies and institutions, this article explains what needs to be included when factoring IROs in conducting double materiality exercises.

Impact Assessment

As a reminder, impact materiality assessment is an overview of the process of identifying, evaluating, and monitoring the potential and actual impacts of the company on people and the environment, based on the company’s due diligence process. Indeed, the impact assessment follows the UNGP guidelines as adopted by the CSRD methodology, ensuring that it follows a process that:

- Focuses on specific activities, business relationships, geographical areas or other factors triggering an increased risk of negative impacts,

- Takes into account the impacts to which the company is associated through its own activities or business relationships,

- Includes consultation with relevant experts or stakeholders to understand how third parties may be affected,

- Prioritises negative impacts according to their relative severity and likelihood (see ESRS 1 section 3.4 impact materiality) and, where appropriate, positive impacts according to their relative scale, scope and likelihood, and identifies sustainability issues that are material for reporting purposes, including qualitative or quantitative thresholds and other criteria used as prescribed by ESRS 1 section 3.4 impact materiality.

Step 1: Calibrating a CSRD Impact Valuation Tool

With regard to the UNGP methodology, the tool developed by Ksapa to assess the impact of the company is structured to answer the following questions:

- Identifying the impact

- What is the sustainability issue linked to the impact?

- Who is the contact person or team responsible for assessing the impact within the company?

- What is the source of the impact?

- Does it affect human rights?

- Is the impact potential or real?

- Is the impact negative or positive?

- What is the cause and effect relationship linked to the impact?

- Where does it occur in the value chain (upstream and/or downstream and/or direct operations)?

- What is the duration of the impact?

Step 2 : Conducting the Impact Materiality Assessment Exercise

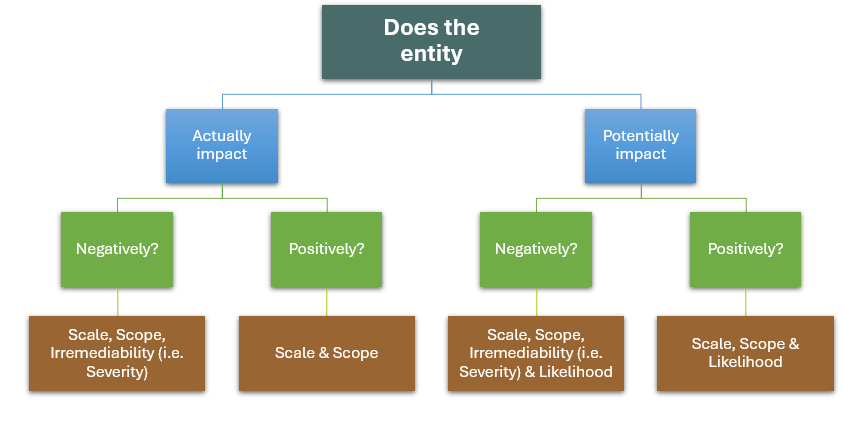

Once the above questions have been populated, the materiality of the impact is defined according to two criteria:

- Severity: It is important to note that the level of remediability depends on whether the impact is negative or positive. If the impact is defined as positive, it is not necessary to measure the level of remediability.

- Probability of occurrence: The probability of occurrence of the impact depends on whether the impact is considered to be potential or real. If the impact is assessed as real, the probability of occurrence is not assessed.

Once all the questions have been answered, it is important to submit the results to the company’s management in order to validate them and ensure their relevance to the company’s reality on the market.

Financial Assessment of Risks and Opportunities According to the CSRD Requirements

The process for identifying the level of importance or materiality of risks and opportunities differs from that adopted for impacts. The best practice for a robust assessment process is to align with the regulatory expectations of the CSRD and to use existing internal company methodologies. In fact, it is essential to adapt to the reality of the company, its activities and its existing internal documents (e.g. risk mapping).

Step 1 : Conducting the Financial Assessment Materiality Exercise

To ensure the relevance and robustness of the financial materiality analysis, the company must first answer a number of questions about the opportunities and risks identified in advance:

- Description of the risk or opportunity

- What is the sustainability issue associated with the R/O in question?

- Who is the key contact within the company responsible for assessing this R/O?

- What is the source of the R/O?

- Does the R/O refer directly to a previously identified impact?

Step 2 : Risk and Opportunity Assessment Criteria

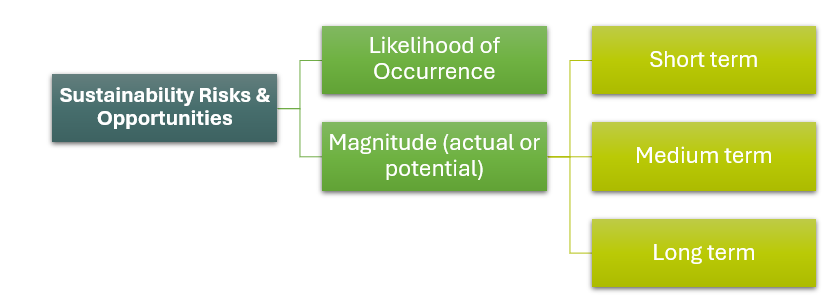

In order to measure the relative importance of risks and opportunities, the company must follow an evaluation process similar to that for impact, comprising two analysis criteria:

- Probability of occurrence

- Magnitude of the R/O: severity of the risk or magnitude of the opportunity

In order to complete the financial analysis, it is important to involve the company’s employees and content experts in the process. This ensures that the valuation is relevant and reliable in relation to the company’s activities and the market.

Definition of Materiality Thresholds According to the CSRD Requirements

Materiality thresholds are defined by the company, taking into account the CSRD guidelines and recommendations. The materiality thresholds make it possible to answer the question of materiality for each of the IROs identified and assessed. If an IRO is considered material, then the related sustainability issue is also material.

Please note! The threshold determines the materiality. However, regulations in force have to be considered. They automatically make the IROs and the related sustainability issue “material”.

Next Steps

Visual Representation of the Materiality Matrix

Once the internal materiality tool has been completed and the materiality results validated by the company’s management, the company can produce a materiality matrix. This illustrates the materiality results by categorizing the sustainability issues. The materiality matrix remains an option at this stage and is not mandatory under the CSRD.

The reporting protocol

The double materiality analysis makes it possible to identify the sustainability issues on which the company subject to the CSRD will have to report within its extra-financial reporting. Ultimately, double materiality is the cornerstone for defining the structure of a company’s non-financial reporting. However, this is only the first step… The scope of the reporting and the data points to be reported still need to be defined. This stage of defining the scope and collecting data is crucial. The company must be meticulous in order to ensure full compliance with the CSRD, bearing in mind that the published report will then be auditable.

Conclusions

EFRAG provides a framework for conducting this dual materiality exercise. However, this framework needs to be operationalized in order to be translated into the strategic and operational reality of organizations. This is the work and expertise provided by Ksapa in this critical and sensitive phase.

- Critical. This concept of double materiality is critical because it subsequently becomes the cornerstone around which the company becomes accountable for identifying and deploying resources and governance to make progress on ESG issues. At the same time, it allows the company to exclude and reduce resources on other non-material issues.

- Sensitive. From the moment that the rules laid down by EFRAG allow comparability between companies, this also means that companies do not have the power to choose what they will or will not consider material. The work is intended to be auditable and the company becomes accountable for the choices made across the double materiality analysis.

This strategic exercise needs to be carried out by consultants who have a solid knowledge of the sector and can offer a service that is totally disconnected from any audit or compliance issues. This is exactly the positioning of Ksapa, which works as a trusted partner with its customers to ensure that the EFRAG concepts are properly understood and that the exercise is interoperable with third-party frameworks (IFRS, for example). The deliverables are then produced for strategic and operational management by the company’s General Management. The auditor then acts as a third party to ensure that the exercise is consistent with regulatory expectations.

Solène travaille au sein de l'équipe Ksapa en tant que consultante spécialisée en droits humains et développement durable.

Très concernée par les questions ESG, elle contribue à des enjeux climatiques, d'économie circulaire ou encore de salaire décent et de conditions de vie au travail. Elle a précédemment travaillé au sein de l'équipe Développement durable de Beiersdorf, où elle s'est occupée des questions d'approvisionnement responsable et de droits humains.

Solène est titulaire d'un master en marketing et communication, ainsi que d'un master en industries créatives et innovation sociale de l'EDHEC Business School.

Elle parle français, anglais et espagnol.