In accordance with the United Nations Guiding Principles on Business and Human Rights, all companies have a responsibility to respect human rights in all their activities, whatever size, sector, location, ownership or structure. This responsibility includes exercising due diligence and integrating a robust and compliant verification and analysis process. This is particularly true for private equity players, who have a front-row seat at every investment decision.

Why Investors are Impacted by Human Rights?

Human rights are inherent to all human beings, regardless of race, sex, nationality, ethnicity, language, religion, or any other status. Human rights include the right to life and liberty, freedom from slavery and torture, freedom of opinion and expression, the right to work and education, and many more. Everyone is entitled to these rights, without discrimination.

United Nations

Investors’ human rights responsibilities

At the heart of the universal program on sustainable development, the Agenda 2030, 17 sustainable development goals have been set. These SDGs cover a wide range of sustainability issues, including respect for human rights with Goal 1 on poverty and Goal 8 on decent work. Thus, “realizing human rights for all” applies not only to companies, but also to investors, by integrating their operational activities and the actual or potential consequences of their investments.

To mitigate the risk of failing to respect human rights, investors must meet several conditions :

- Adopt a policy of commitment to respecting human rights

- Activate a due diligence process by implementing this commitment policy within their governance and management system, preventing and mitigating negative risks, monitoring ongoing human rights consequence management and communicating with stakeholders.

These two conditions are supported by robust and precise European regulations on respect for human rights.

Key Implications of Human Rights Due Diligence for Investors

The Principles for Responsible Investment (PRI)

The Principles for Responsible Investment encourage investors to consider environmental, social and governance (ESG) issues in their management of financial assets. The PRI believe that long-term value creation requires a sustainable and economically efficient global financial system. Here are the six fundamental principles to be respected :

- ESG considerations in investment analysis and decision-making processes

- ESG issues taken into account in shareholder policies and practices

- Require investee companies to publish information on ESG issues

- Promote acceptance and application of the Principles among asset management players

- Collaborate to increase the effectiveness of the application of the Principles

- Report individually on activities and progress in implementing the Principles.

Finally, adopting these six principles means improving the performance of investment portfolios, avoiding human rights violations in investment decisions and complying with market regulations.

Investors face a compliance challenge

The years 2023 and 2024 mark a turning point for companies in terms of human rights, with a strengthening of existing regulations and the entry into force of several new directives. Faced with this tightening of the law, the market is increasingly regulated, and companies and investors are faced with the challenge of compliance.

Here are the various regulations to which investors are subject in order to meet the challenge of respecting human rights :

- The DNSH principle (“Do Not Significant Harm”) helps prevent investment processes leading to human rights violations, in order to guarantee a green transition of the EU economy that respects human rights. It complements the European Taxonomy by requiring economic and financial players to cause no harm to the six environmental objectives that determine the sustainability of an activity. These objectives are :

- Mitigation of climate change

- Adaptation to climate change

- Sustainable use and protection of water resources

- Green transition to a circular economy

- Pollution control

- Protecting and restoring biodiversity and ecosystems

- The Sustainable Finance Disclosure Regulation (SFRD) addresses the issue of sustainability reporting in the financial services sector. Under Article 2(17), investors claiming to have made a sustainable investment must demonstrate that :

- This is an investment in an economic activity that contributes to an environmental or social objective;

- The investment does not significantly undermine social or environmental objectives.

- Investee companies follow good governance practices

- The Corporate Sustainability Due Diligence Directive (CS3D) or European duty of care requires companies to report on the risks of human rights and environmental abuses present throughout their value chain.

Faced with these numerous regulations, economic and financial players, particularly in the private equity sector, are at a loss. That’s why the OECD is proposing a methodology for understanding the duty of care.

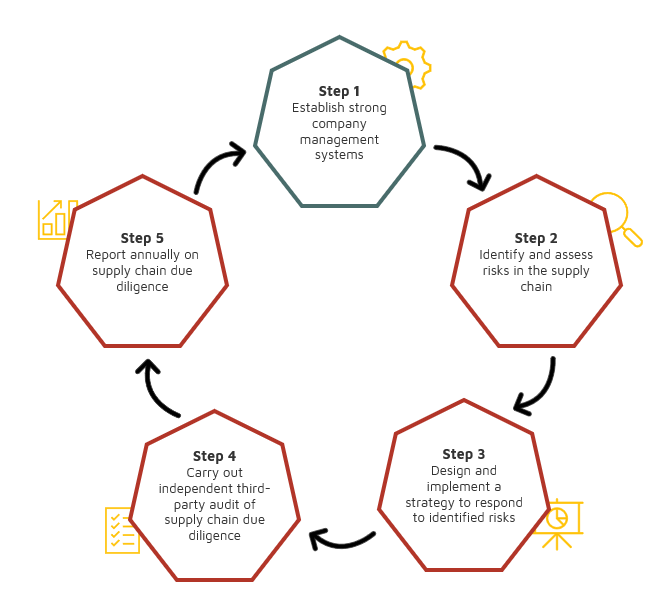

OECD 5-step due diligence methodology

OECD guidelines enable companies and investors to comply with DNSH principles and avoid greenwashing.

To help investors adopt these best practices, Ksapa has created a toolbox describing the process and the steps to follow.

The Human Rights Toolkit Developed By Ksapa

The “Sustainability in the value chain” working group

In 2023, Ksapa had the opportunity to lead a working group entitled “Sustainability in the value chain” including 14 private equity companies. The aim was to help them understand human rights issues and develop a toolbox. The toolkit details best practices for integrating human rights issues into investment decisions.

Toolkit objectives

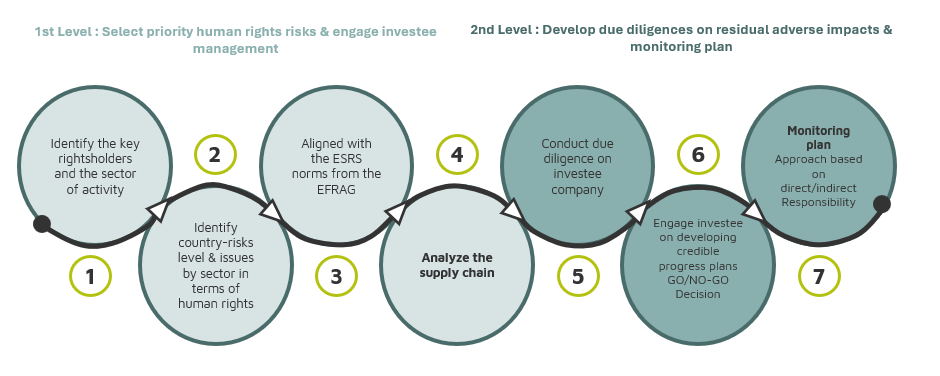

Ksapa has created a toolbox to guide private equity players through the due diligence process. It is based on various international standards and regulations, and cross-references the essential dimensions of human rights, the rights holders, the company’s activities and the country of operation.

The toolbox aims to :

- Be adaptable to all company sizes

- Clarify human rights

- Clarify human rights regulations

- Help investors map human rights risks and act on potential issues

- Be operational, concrete and simple

Ksapa relies in particular on basic standards and benchmarks such as SASB and MSCI, but above all on the ESRS defined by EU EFRAG, which help to structure a sustainability strategy with comparibility in mind.

Supply chain analysis is a long and meticulous process, but it enables investors to identify and prioritize human rights risks, and to define a road map and remediation plan.

Best practices from the toolbox

By following these steps and adapting them to the company’s sector of activity, investors are able to significantly reduce the risks associated with human rights issues. Through this proactive approach, private equity players can better assess human rights risks and integrate human rights considerations into their investment decisions.

In conclusion, private equity companies are directly concerned by human rights issues, but also by other sustainable development issues. The methodology described in this article can also be used to provide guidelines for assessing other sustainable development risks (climate change, decent wages, damage to biodiversity, etc.). What’s more, by using international standards, mainly EFRAG’s ESRS, public and private players, and not just investors, will be better able to grasp the challenges of sustainability and compliance. Indeed, compliance will be a key issue in 2024, with the new European regulation CSRD (Corporate Sustainable Reporting Directive).

Find out more:

- Contact us : contact@ksapa.org

- Visit our articles and publications on human rights : https://ksapa.org/advocate/blog/

Solène part of Ksapa's consulting team, working notably on human rights and sustainability.

With a keen interest for climate issues and circular economy, she has previously worked within Beiersdorf’s Sustainability Team where she tackled issues of responsible sourcing and human rights.

Solène holds a Master's in marketing and communication, as well as a master in creative industries and social innovation from the EDHEC Business School.

She speaks French, English and Spanish.