This article is part of a series republished via the Council of Business and Society platform.

Ksapa held two webinars on financing the energy transition across operations and supply chains. In September, we heard from Yann Guyomar (Mazars) and Raphaël Hara (Ksapa) to flesh out the socio-environmental and economic imperative of the energy transition. Last December and to drive home the importance of rallying behind these goals, we invited additional perspective from Policy Advisor to Chile’s High-level Climate Action Champion, Ramiro Fernandez, Mazars partner, Leïla Kamdem-Fotso and Strategy Lead at H&M Group, Kim Hellström.

Find out more from the webinar replay on our website !

The Call to Action

COP 21 clarified the role and importance of cities, local governments, universities, and investors in rapidly securing a global energy transition. In September 2019, 66 countries committed to a net-zero objective. In November 2021, they should be 150. Much in the same way, the number of cities and businesses involved more than doubled in the last 2 years.

This signals a growing maturity among key players. High-level climate action champions appointed by COP leaders have significantly contributed to raising awareness in their respective countries, according to Ramiro Fernandez. As such, it is expected 80% of the global GDP should be committed to net-zero by November 2021, ahead of COP26 in Glasgow.

This zero commitment must also meet a minimum set of procedural criteria. The prescribed process follows 4 steps, from pledging to net-zero by 2040 or 2050 to planning short to medium-term steps, before proceeding to delivering on these targets and disclosing progress. This baseline allows for commitments to be effectively translated into operational realities. That said, this race to zero can only be won if all countries and all players join the fight, as stated by Antonio Guterres.

The State-of-Play on Financing the Energy Transition

To move beyond words and affect sweeping action toward achieving net-zero, massive investments are needed. Back in January 2020, the European Commission already estimated an additional annual 260 billion euros investment would be necessary to achieve the 40% GHG reduction goal States set to align with the Paris Agreement (Hainaut, Cochran, I4CE). As Ursula von der Leyen also pushed the 2030 goal up to 55%, this estimate will likely be reappraised, demonstrating the ever-increasing need for further investment (Forbes, 2020).

In that respect, new investment mechanisms are being developed that multiply financing resources. Among them are thematic investment funds, like Unilever’s €1 billion fund to mainstream plastics substitutes and Microsoft’s $1 billion Climate Innovation Fund backing carbon-reduction technologies. EU taxonomy-compliant green bonds, or new market mechanisms such as the EU Emissions Trading System are similarly funneling investment toward the energy transition. New forms of public/private partnerships or blended finance schemes such as risk underwriting, market incentives or guarantees likewise reassure investors as they approach new or developing markets. This ultimately favors the development of new technological solutions capable of accelerating the energy transition. As such, new financing tools are on the rise and reinforced by political decisions, such as the Green New Deal, and the evolution of the regulatory context, notably in the wake of the green taxonomy.

Undertaking bold energy transition projects requires significant investments, particularly renewable energy production, energy efficiency or product eco-designing. As such, federating value chains players is critical to achieve climate transition goals. Improving value chain resilience to the energy transition indeed depends on mobilizing the ecosystem of suppliers and subcontractors upon which companies depend. Only then can they hope to achieve greater operational safety in the face of growing uncertainties.

Ksapa’s Solutions to Address 3 Key Chokeholds Companies Face in Activating Energy Transition Projects

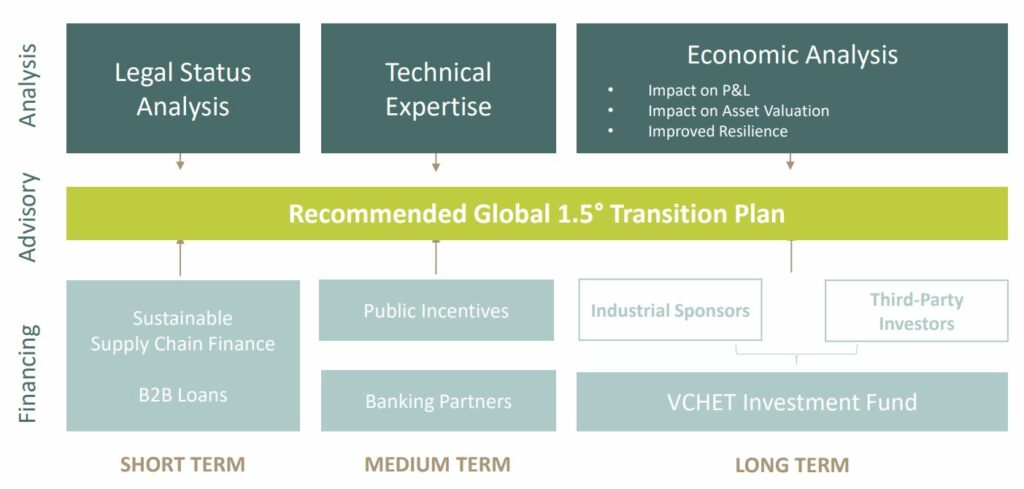

Below is an example of a structuring scheme developed by Ksapa to address 3 key chokeholds companies face in activating energy transition projects – namely, the lack of time, competence and investment capacity.

This scheme is designed to be easily adaptable and replicable across the value chain, ultimately allowing for greater resilience and impact. This structuration aptly combines technical expertise and financing solutions while engaging corporate ecosystems of priority suppliers and subcontractors.

The Regulatory and Financial Landscape

For the finance to support the energy transition, regulation is critical. Mark Carney’s momentous Tragedy of the Horizon speech marked a buildup in climate regulation, according to Leïla Kamdem-Fotso. While financial companies and insurers have a key role in directing financial flows towards the energy transition, regulators must imperatively step in for them to consider transition risks in their broader management models. A 2020 Mazars survey stresses banking supervision and regulation authorities must still step up their game. Indeed, even though 70% of the central banks surveyed see climate change as a major threat to financial stability, 59% do not fully supervise climate risk management.

Though marginally implemented by Dutch, English and French central banks, climate stress-tests may well prove instrumental in revamping risk management frameworks, to drive financial players’ allocation policies and financial flows as a result. These climate stress-tests are expected to go mainstream, as 79% of central banks intend to embed to climate in routine stress-tests in the future. This movement testifies of the regulators’ will to encourage banks to integrate climate-related risks in their daily operations and risk management processes.

Finally, and with regards to incentivizing green finance, the Mazars survey showed only 13% of central banks support green-supporting or brow-penalizing factors linked to capital requirements for such assets, mainly due to the lack of evidence linking green assets with fewer risks.

Incentivizing Industry Action

A prime industrial use case, H&M developed bold goals following its risk assessment. The Group committed to halving its carbon emissions every decade and becoming climate positive by 2040. That said, challenges have arisen in the form of actionable data and cross-supply chain financing.

In that respect, a key progress point and investment linchpin hinges on industries’ ability to precisely measure their impact and progress, as well as design and implement innovative financing models for supply chain players, at the local – and perhaps facility – level.

With a view to kickstart the climate fight and tackle corollary implementation challenges, speakers outlined the following advice:

- Perfectionism cannot get in the way of corporate action. The benefits of climate voluntarism are not necessarily scientifically measured and tailored, yet progress lies in experimentation and trial-and-error processes. Companies should therefore be encouraged to try various initiatives and redirect efforts accordingly, as part of a continuous improvement framework.

- Companies should also rely on the convergence movement set in motion since Mark Carney’s speech. Indeed, new players, coalitions, resources, and regulations are ramping up to support corporate leadership on the climate front.

Conclusion

Though the Covid-19 crisis offers a bleak vision of the future, recent years have seen the global financial system gradually move in the right direction. It indeed appears most economic players have fully integrated that 2030 is the delivery decade so that 2021 should be a turning point in the climate fight.

In response, Ksapa is established a purpose-driven company. Ksapa’s goal is precisely to bring together the technical, legal and financial expertise necessary to support investors in transitioning their assets and companies in developing the necessary financial structures for their sites (factories, warehouses, stores …), joint ventures and strategic suppliers. Our team of experts helps leading organizations mobilize the financial and technical means to significantly accelerate the transformations brought to bear by decarbonation, sobriety and renewable energy developments.

Adrien is a SUTTI Program Officer. He’s responsible for the development, operational implementation, and monitoring of SUTTI programs. He participates in designing financial structuring schemes leveraging SUTTI’s impacts.

He has previous experiences in various industries, within public, private, and non-profit organizations. Before joining, he was involved in microfinance and social entrepreneurship initiatives in Cambodia and the Philippines, after working for Danone and RATP.

He holds a Master’s in Finance from Paris-Dauphine University, as well as a Master in Management from ESSEC Business School.

He speaks French, English, and Spanish.