Investors are increasingly expected to scale ESG funds across their assets under management. This is indeed key for them to meet demand as well as regulatory pressure. Here, Ksapa shares key insights into navigating the complexity of scaling ESG funds across your portfolio. Read on and get this right for the years to come!

Growing Demand for Investors to Scale ESG Funds

1. Better Data Warrants New Expectations

ESG data has become substantially richer in the past couple of years. Data quality is also improving. This might just be the beginning. Experts partnering with Ksapa are indeed very confident ESG data quantity and quality is bound to improve in the coming years.

As a result, asset owners and regulators are now in a position to demand ESG disclosures from fund managers. In France for instance, the adoption of article 173 pioneered enhanced climate reporting back in 2016. This has also convinced more managers to analyze the impact of ESG issues on their porfolio performance and characteristics. Not only that, they are now in a position to do so at scale.

Despite regulatory evolutions intended to better harmonize ESG data, ESG data still lacks quality and comparability. Initiatives abound that strive to achieve just that. While they have certainly fostered progress, results remain insufficient. That said, the times have never been riper to scale ESG funds across your portfolio.

2. Research Clearly Ties ESG Credentials and Financial Performance

Non-financial analyses are still fairly new. They only go back as far as the 1990’s. That is not nearly as much as traditional financial analysis, which enjoys on over a century of supporting research.

There are niche players that tend to invest in value-based approaches, which generally coincides with the field of socially responsible investment (SRI). The issue is they are all too often confused with their mainstream counterparts. The latter focus on garnering data to meet market or regulatory demand, feed their analyses and ultimately boost their performance. On the one hand, impact investors motivated have always been open to lesser returns, provided they convey better “ethical guarantees”. On the other, mainstream players are particularly reluctant to accept anything less than sound risk management and returns.

Evidence has however repeatedly pointed to the financial materiality of ESG issues. This allows asset and fund managers to embed their ESG consideration as an integral part of a rigorous investment process. This could very well come to refute the past misconception that ESG or SRI players are all about values. Based on a core set of values, they scale ESG funds because it makes business sense to do so.

3. Adapting to Normative Pressures on Human Rights and Climate Change

Mounting societal pressures led asset managers to develop a sounder undestanding of corporate behavior before adding them to their portfolios. Compliance is another key driver, as demonstrated by the recent PRI Human Rights guidelines or the development of climate stress–tests.

Working with energy, manufacturing or construction companies, Ksapa is regularly involved in juridictional or conflictual cases at the asset level. Investors are indeed increasingly scrutinized and may be brought to court for lack of sufficient due diligence. The result may vary, from Human Rights abuses to infringing on their climate commitments.

4. Scale ESG Funds to Boost Returns and Societal Impact

Up until recently, investors had learned to operate with low interest rates. Now, as human beings with their own social lives, they also bear witness to a global socio-environmental and sanitary upheaval.

Key players are therefore exploring whether and how they may invest differently, without necessarily generating more financial performance. At the very least, this hints to a renewed aspiration to harness the power of capital and alter unsustainable corporate behavior.

We then would stand a chance to address the world’s most agonizing problems, starting with inequity, climate change and circularity.

Reading the Landscape to Effectively Scale ESG Funds

ESG Fund Metrics Are Inflating Yearly

The Principles for Responsible Investment were launched in April 2006 at the New York Stock Exchange. Since then, the number of signatories has grown from 100 to over 3,000. As more managers sign on to the PRI, the market is being flooded with ESG investment solutions. As of 2020, the PRI claims to represent approximately USD 120 trillion in assets under management. This might be about 33% of global financial assets under management worldwide.

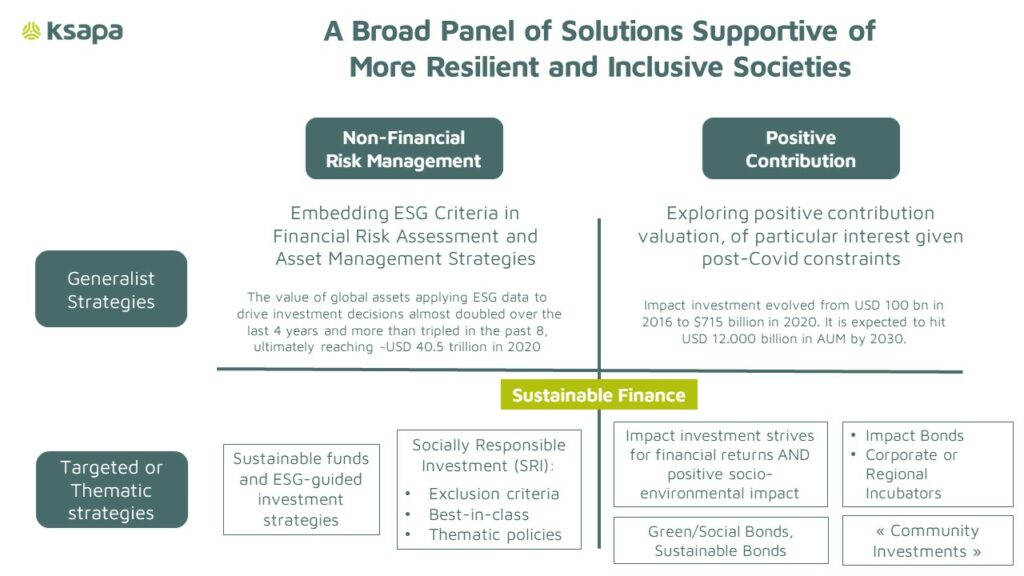

This is certainly impressive in absolute numbers. So is the panel of readily-available sustainable finance solutions. The following graph ventures to offer a helicopter view of this complex environment.

This graph shows how broad the universe of sustainable finance solutions really is. Though it amounted to USD 40,5 trillion in AUM in 2020, sustainable finance is particularly fragmented. This can be attributed to a few of the investment market and the ESG ecosystem’s inherent characteristics, as addressed below.

Balancing Diversity and Comparability of ESG Strategies and Indicators

ESG strategies are certainly very diverse. Some managers may want to comply with basic integrity principles. Others would claim leadership on Human Rights without providing indicators to back it up. Others yet may consider their ESG funds align with the Paris Agreement. They may nevertheless include a good number of lines which clearly go against a 1.5°C degree global warming trajectory. In any case, managers would be hard-pressed to prove otherwise.

We recommend they first start with a greater comprehension of just how diverse ESG strategies can be. From there, they may consider the indicators these strategies call for and how they might perform based on select goals. That exercise is in itself difficult. It is even harder to compare.

There may well be only one certainty with regards to ESG Fund comparability. That is: the fiduciary duty of institutional investors is to safeguard the financial interests of their beneficiaries. They however have the tools (i.e. capital allocation decisions) to support the integrity and stability of the whole financial system. They may reward responsible conduct and positively impact global issues, ultimately living up to their mandate.

The more funds prove they deliver on ESG promises without compromising their financial potential, the more successful they will be. Only then may they generate sound financial returns while performing against their ESG criteria. From there, investors would do well to start planning how to scale ESG funds across their portfolio.

Solutions to Scale ESG Funds and Boost Overall Performance

By following the 4 suggestions below, managers can maximize their chances of increasing size and performance of ESG funds.

1. Design an Authentic ESG approach

By 2025, it is very likely that every ESG fund will at least claim basic compliance. In other words, they may hope to tick the box on the Paris Agreements or Human Rights standards.

Their market is however growing fast and become all the more competitive. Managers need to explore other differenciators. To that end, top executives, portfolio managers, ESG specialists and client representatives need to understand the following dynamics:

- Why ESG is important for any given firm as a market player;

- How it affects portfolio performance;

- The extent to which it might be relevant to their clients.

Addressing the Disconnect With Conventional Investment Methods to Scale ESG Funds

For the time being, ESG strategies often remain tied to the “original” portfolio constructed by the investment team. That is the basis upon which investors start excluding poor performers, upon the recommendations of their ESG team. This in turn defines strategy, quantified through ESG metrics.

The resulting disconnect between investment and ESG teams is unreasonable. Investment professionals instead need to fully understand the dynamics between ESG and financial performance. They must in fact learn to refer to ESG investing not as a separate issue, but as an integral part of Corporate Finance 2.0. It is increasingly obvious that the materiality of sustainability topics must be considered at the sector and/or regional level. This way, they may be grounded in real-world business, in such a way as to assess risk level and opportunities.

That is how investors may ultimately drive performance while overseeing volatility control. With such an authentic approach, they would effectively address any obstacle related to performance.

2. Work on A Robust Data and Decision Tree

Every strategy pursues specific investment goals. It may seek to maximize absolute performance or risk-adjusted performance. Another goal might be to minimize volatility and/or drawbacks, or maximize ESG outcomes. It follows managers and client-facing personnel must be crystal clear on their strategic priorities and the best way to achieve their goals.

We therefore encourage them to explore the following two concepts as a means to track strategy and implement concrete solutions whilst managing high volumes:

- Identify ESG terms which really illustrate the strategy throughout the real-world transaction cycle. You may then tag lines, transactions and events to effectively track strategy implementation across operations. That is how you may identify and aggregate the data necessary to connect ESG strategy implementation with existing (or perhaps missing) data available in-house;

- Develop a decision tree to efficiently scope your investment universe. Moving forward, you may qualify and flag transactions to clarify to what extent your ESG fund is developing in line with its non-financial goals.

Illustrative Applications of a Decision Tree

Take an ESG strategy contered on a climate commitment, for instance. Applying this ESG strategy to a fund that primarily invests in real-estate debt may imply exploring whether and how to maximize the inclusion of so-called green building assets across the portfolio. Those green building assets are very likely linked to real-estate credits and loans. Tagging real-estate lending transactions may be based on BREEAM or HQE certifications (given as illustrative climate-foward standards). This may be done during transactions or at once, across existing lines of operations.

By granting additional loans to complete energy efficiency Capex efforts or renewable energy production investments, managers could indeed tag green building assets within their portfolio of real-estate lending activities. This would allow them to automatically monitor the flagging of EU-taxonomy compliant lines across their portfolio. Managers ultimately stand to benefit from designing a data and decision tree to efficiently monitor their performance and and scale ESG funds across their portfolio.

Crucially, when it comes to sophisticated institutional investors and financial advisers, managers need to explain what gap their strategy intends to fill. When presented with an ESG strategy, a major challenge of allocators is precisely to understand where to allocate it. It matters little whether a fund follows an generalist ESG-guided investment strategy (emphasizing sector materiality) or a specific sustainability-themed oriented policy. What is critical for managers is to demonstrate that targeting ESG objectives will drive financial performance and/or better volatility control.

By developing robust decision trees complete with a clear tagging and flagging methodology, teams may distinguish their offering from their peers. In other words, they get a chance to explain how they intend to monitor their financial and non-financial performance to their advantage.

3. Share Robust ESG Reports

Given ESG considerations are among key factors impacting your allocation decisions, investors expect you to elaborate on their overall impact on portfolio performance. Consider questions like “Are ESG characteristics a positive or a negative contributor in terms of returns and risk control?” or “To what extent may the excess relative performance be attributed to ESG considerations?“. Satisfactorily addressing these key interrogations not only fosters transparency, it also helps investors understand the importance of ESG integration as well as the corresponding trade-offs.

That said, impact reporting (especially for ESG funds) should not exclusively focus on financial metrics. It should also address societal issues (and increasingly so). For now, ESG reporting on investment funds remains fairly under-developed – to say nothing of impact reporting.

Select Options for Effective ESG Disclosures

Key players now provide an overall ESG score for each fund, which is calculated by ESG ratings providers. On the one hand, those scores are the most basic type of information a fund can provide. On another, their lack of meaning and transparency ultimately mean they are of little help.

A somewhat more advanced form of impact reporting involves disclosing a fund’s performance based on key ESG topics (e.g. carbon emissions, CEO pay, diversity metrics) against a relevant benchmark. Other strategies specifically target climate change. In that scenario, adopting a reporting framework in line with the appropriate metric providers — in this example, the Task Force on Climate-Related Financial Disclosures — is essential to demonstrating your are indeed delivering on all your strategic goals.

Ultimately, reporting should reflect the portfolio’s financial, social, and environmental performance. The underpinning objective is to transparently capture its environmental, employment and product impacts, as described by the Impact-Weighted Accounts Initiative. In other words, a comprehensive report should disclose the impact-weighted profitability of the portfolio, relative to its alternatives.

We cannot overstate how much of a differentiating factor transparently disclosing details on portfolio impact can be. It asserts your credibility as an expert in the field and can also help mitigate any track record–related concerns.

4. Know your Audience To Scale ESG Funds

As a rule of thumb, it is essential you allocate your resources prudently. The best way to do so is to focus on attracting clients most likely to support you at this early stage. This entails approaching clients for whom your strategy serves as a solution to address gaps in their portfolios or readily-identified concerns.

When it comes to sophisticated institutional allocators, the key goal is to understand their stance on ESG investing. Does is garner top-management support? Have they made public commitments to fully integrate ESG issues? Have they made unfavorable headlines because of ESG considerations? Is the regulatory environment urging them to increase their allocations to ESG funds? In short, you must explain why your solution is relevant to them. How it can help them achieve their own goals.

Moving ahead, we recommend losing the notion one or two investors will alone bring the fund to the desired level of asset management. Instead, focus on smaller opportunities, which are that much likelier to materialize. For example, family offices tend to be more relaxed in their requirements, but often have a greater appetite for innovation than larger, more institutional investors. As a result, their client bases may have strong views on ESG issues. They may positively look onto their investments advantageously impacting their business.

By knocking on the right door, you are effectively solving the chicken-and-egg conundrum.

Conclusion

Corporate non-financial reporting has considerably evolved in recent years. A number of voluntary reporting frameworks the likes of the GRI, SASB/IIRC, CDP, TCFD, CDSB now help companies disclose ESG data that is altogether more relevant and comprehensive.

Just last year, several initiatives were developed with a view to harmonize corporate Environmental, Social and Governance (ESG) disclosures. Revealingly, the European Commission is now looking to amend the Directive on the Non-Financial Information of Companies (NFRD) to streamline more reliable and comparable information. The World Economic Forum similarly developed a standard which selected indicators from existing frameworks organized around 4 pillars of governance, people, planet and prosperity. Finally, in October 2020, the IFRS Foundation (which hosts the International Accounting Standards Board) issued a request for comments on a proposal to create a sustainability standards board. Meanwhile group of 33 institutional investors, representing a combined $5.1 trillion of AUM committed to transitioning their investment portfolios to net-zero greenhouse gas emissions by 2050.

These different developments all point to the impetus around ESG investing. It has never been bigger and investors will keep increasing their allocations to ESG funds. Beyond tapping in the relevant methodology and data management, managers must develop greater competence and hands-on experience on ESG topics. There lies the key to effectively scale ESG funds and navigate the related complexity.

Président et Cofondateur. Auteur de différents ouvrages sur les questions de RSE et développement durable. Expert international reconnu, Farid Baddache travaille à l’intégration des questions de droits de l’Homme et de climat comme leviers de résilience et de compétitivité des entreprises. Restez connectés avec Farid Baddache sur Twitter @Fbaddache.