Learn how credible biodiversity credits drive real restoration, avoid greenwashing, and deliver lasting benefits for nature and communities.

Category Archives: Sustainable Finance & ESG

Sustainable investment, ESG strategy

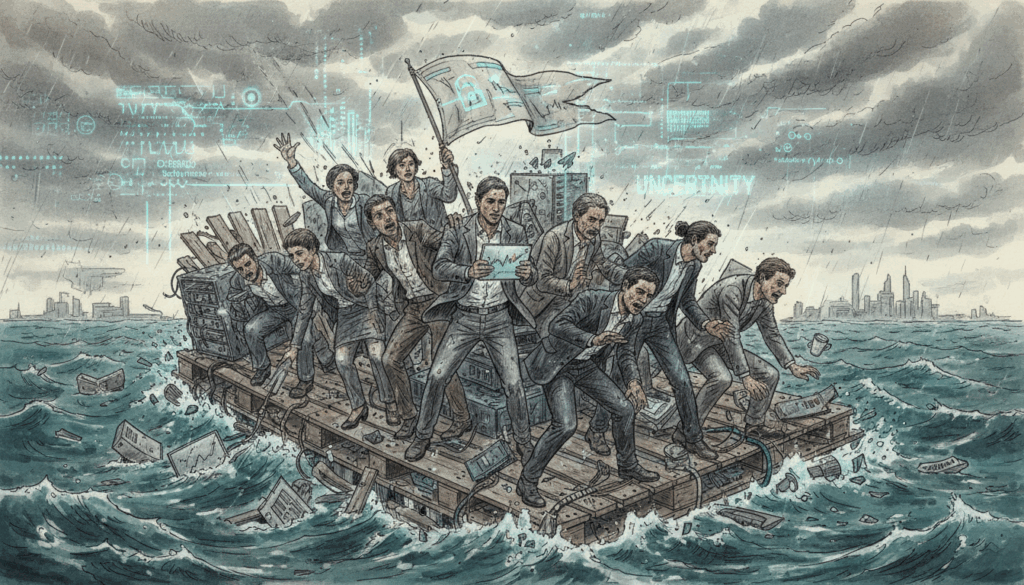

European businesses face trade wars, geopolitical tensions & slow growth. Learn how to build resilient operations through strategic risk management.

CSDDD faces deep cuts via EU Omnibus. Why do companies diverge? What should businesses do now to stay ahead?

As COP30 marks 10 years since the Paris Agreement, the gap between global pledges and local climate action has never been wider.

SEC Chair threatens to ban IFRS standards over sustainability reporting, undermining investor access to material financial information.

Indonesian islanders sue Holcim in landmark climate case, signaling new era of corporate liability. All industries now face legal risk.

Learn how whistleblower protection prevents costly litigation and reputational damage while strengthening internal governance frameworks.

International Court of Justice declares climate change an “urgent threat”. Nations now have binding legal obligations.

New UN reports provide crucial guidance on applying human rights principles to AI procurement and deployment. Learn how businesses can implement responsible AI practices and ensure compliance with emerging regulations while protecting human rights throughout the AI lifecycle.

Board of Directors, Climate Change, Corporate Social Responsiblity (CSR), Governance, Human Rights, Resilience, Responsible consumption, Responsible sourcing, Stakeholders, Sustainability, Sustainable Development Goals (SDG), Sustainable Finance & ESG, Work Conditions

Smart Regulation Drives Growth: OECD Insights

OECD research shows smart regulation boosts business. Learn how removing trade barriers and shaping better practices drives sustainable growth