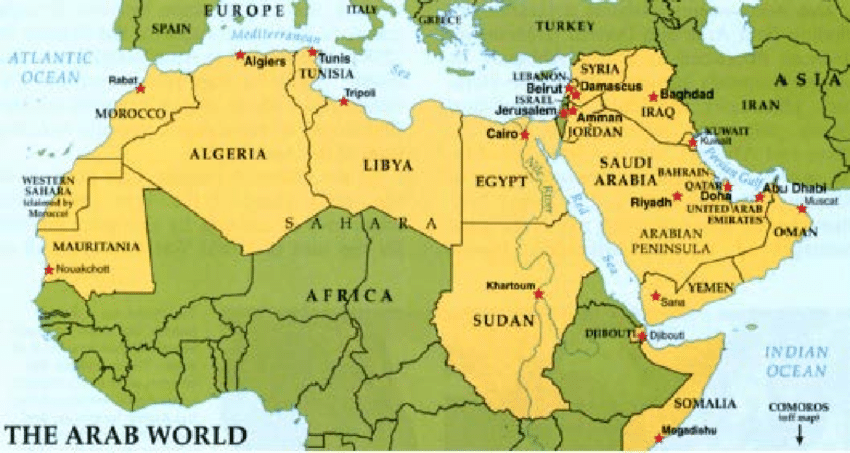

The business landscape in the MENA (Middle East and North Africa) region is diverse and dynamic. It encompasses a wide range of industries, including oil and gas, construction, tourism, manufacturing, finance, and technology. There has been a growing emphasis on economic diversification and a shift towards knowledge-based industries in recent years. Promising sectors such as information technology, renewable energy, healthcare, and e-commerce are gaining traction.

However, it is essential not to put all the economies of the MENA region in one bucket; there are striving economies like the GCC countries and developing economies like Morocco and Egypt, but many countries are in conflict, like Palestine, Israel, Syria, Lebanon, and Yemen. While the MENA region offers significant business opportunities, it also faces various challenges, including political instability, regional conflicts, climate crisis, regulatory complexities, and socioeconomic disparities. However, initiatives are underway to foster entrepreneurship, support innovation, and promote sustainable growth, leading to an evolving and promising business environment in the region.

Responsible business refers to companies conducting their operations in ethical, sustainable, and beneficial ways to all stakeholders – including the environment, employees, customers, suppliers, communities, and shareholders. As awareness of global challenges grows and stakeholder expectations evolve, are MENA businesses adopting responsible practices?

Many companies in the Middle East are designing comprehensive, sustainable strategies that open the door to financial and business opportunities. However, in the absence of robust regulatory frameworks, businesses only reinvent themselves, embracing and aligning their strategies and operations to meet specific standards because this will give them access to finance. Which underpins the pivotal role finance can play in instilling and strengthening responsible business practices.

Here are a few keyways financial actors can contribute through:

- The integration of ESG investment criteria in investment analysis and decisions: ESG assessments and social considerations are no longer “trends.” Investors should include criteria in their investment analysis and decision-making processes. By doing so, they emphasize the importance of responsible business practices, potentially leading to a higher demand for companies with strong ESG records, thereby incentivizing other businesses.

- Better understand the local context in which they operate: Investors should engage in thorough screening and due diligence to identify, understand, assess, and address the adverse effects of a business project or policy on the human rights of individuals and communities. Due to cultural, political, and socioeconomic specificities in the MENA region, undertaking an HRIA here may require special consideration of several factors:

- Political landscape.

- Cultural sensitivity.

- Legal framework and enforcement.

- Stakeholder groups.

- Conflict and security issues, considering an escalation plan and responsible divestment.

- Climate impacts, including environmental degradation and resource scarcity.

- Labor rights.

- Gender rights.

- Economic Disparities.

- Language and communication.

- Stewardship and Advocacy: Investors can act as stewards of capital by advocating for better ESG practices in the companies they invest in. This might include promoting transparency, supporting anti-corruption measures, and pushing for better disclosure of ESG risks and opportunities.

- Partnerships and Collaboration: By partnering with NGOs, governments, and other stakeholders, investors can support initiatives aimed at improving ESG standards and practices. This could include educational programs, research initiatives, or joint investment in sustainable infrastructure.

- Capacity Building: Investors can support the development of responsible business practices by providing training and technical assistance to companies in the MENA region. There is a general lack of awareness of the existing normative and regulatory frameworks. Governments and other institutions need to do more to raise awareness of the roles and responsibilities of businesses to respect human rights. This helps businesses develop the necessary skills and knowledge to implement responsible practices and enhance their competitiveness.

- Dialogue with Policymakers: Engaging in conversations with regional policymakers to advocate for regulations that support sustainable development can create an enabling environment for responsible business practices.

- Customized Investment Solutions: Developing investment products that meet the specific ESG needs and values of the MENA region, taking into account cultural sensitivities and societal priorities.

Today, it is not a competitive advantage to be “doing the right thing” and ensure the protection of the rights of those impacted. Leading companies in that space face the risk of being cast aside for another company that simply has a better financial offer.

To drive responsible business, precisely the ESG agenda in the MENA region, businesses and assessors should effectively tailor their approach to its unique context, working closely with local experts and communities while maintaining alignment with international human rights standards and guidelines.

Krystel Bassil

Krystel is senior consultant, contributing to Ksapa’s consulting and advocacy missions, on the topic of business and human rights and more generally sustainability. Krystel Bassil is also Senior Legal Officer of the Human Rights and Business Unit at the Syrian Legal Development Programme (SLDP). Prior to that Krystel worked as a business and human rights consultant advising along with leading experts on a wide range of projects across the private sector, international organizations, and academic institutions. She is admitted to the Beirut Bar and worked as a lawyer in international arbitration and human rights. Krystel holds a LL.M. degree from SOAS, School of Oriental and African Studies, University of London, a law degree in public law from the Holy Spirit University of Kaslik, Lebanon, and a degree in political science from the Saint-Joseph University of Beirut. She is fluent in French, English and Arabic.