Human Rights is an important topic that is connected to the global environmental agenda. Anyone practicing in the sustainability and impact sector must have a clear understanding of the global issues of human rights. In this context, Ksapa organized a webinar on Using Effective Human Rights Due Diligence to Streamline Compliance Efforts, and this blog outlines the key takeaways.

Tag Archives: Boards of Directors

The war in Ukraine is putting pressure on the fragile gains of international law as well as the timid climatic efforts undertaken in recent years. The war in Ukraine is dramatic, yet predictable. Ksapa therefore encourages its community of companies and investors to ponder the following 3 learnings.

Ksapa explains why the 2022 EU Declaration on Digital Rights provides interesting content to advance human rights across digitalized lives.

Ksapa explains why the 2022 EU Declaration on Digital Rights provides interesting content to advance human rights across digitalized lives.

Ksapa explains the concept of double materiality and underlines the importance of risks/opportunities in the financial and extra-financial aspects of the exercise.

ESG due diligence is becoming a market standard in private equity. Meanwhile, impact investing is reshuffling the cards for a growing number of players. Here are a few pointers to help you address these developments. Last month, the AFITE (Organization for the Financing and Transfer of Companies) interviewed our Managing Director as part of a […]

Discussions at the Davos 2021 Summit made our global roadmap crystal clear: it’s prime time for a Great Reset. Boards are key to Just Corporate Transitions. Ksapa outlines a 4-step plan to convince companies to work at the interface of climate and societal issues.

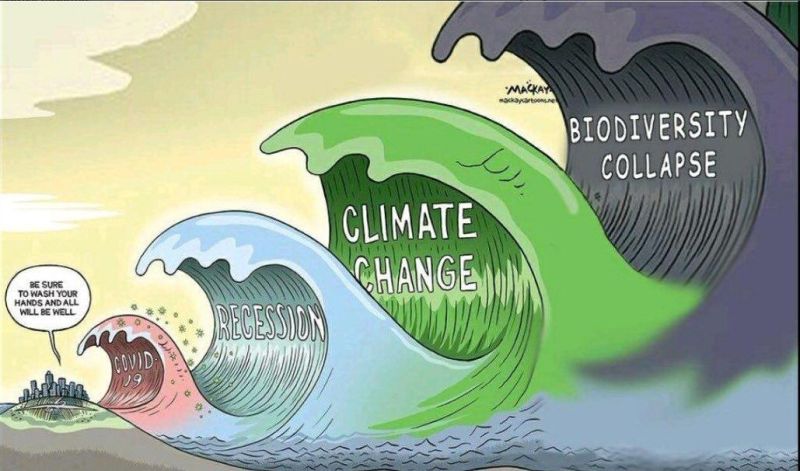

If 2020 was the year chips all fell into place, 2021 kickstarts action against the 2030 Global Agenda. Marred by a pandemic shock, the last 12 months exemplified the impacts of interwoven climate, social and digital crises.

2020 is coming to an end. A momentous year, it warrants particular reflection. In open discussion with our customers and partners, we draw the following 3 key learnings

Energy transition needs massive funding. In discussion with stakeholders, Ksapa outlines in this article its solutions to address 3 key chokeholds companies face in activating energy transition projects – namely, the lack of time, competence and investment capacity