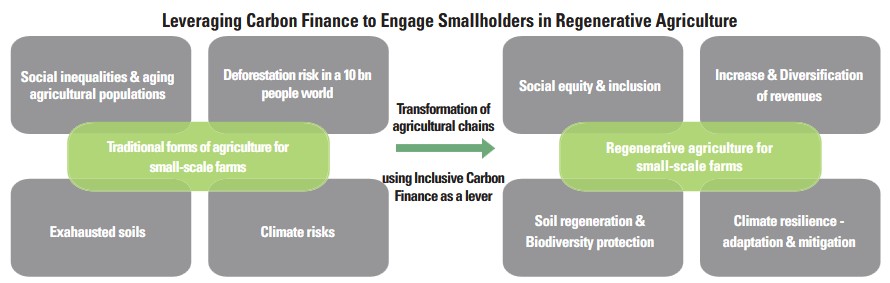

The need to foster the emergence of economic systems that are not only sustainable and resilient – but also regenerative for both the environment and the social fabric – is becoming increasingly compelling. This requires adopting a multi-dimensional approach, working on different dimensions of impact at the same time, but also bringing together stakeholders from different backgrounds – public, private, investors & civil society – around common objectives that allow externalities to be valued.

This article was first published by Convergences here.

A Demonstration of Regenerative Agriculture and Carbon Finance

In this context, regenerative agriculture appears to be one of the most promising and concrete solutions for the ecological and social transition:

• The agricultural and forestry sector represents 24% of global greenhouse gas (GHG) emissions;

• Adapting to climate change requires reshaping the balance of farms;

• Soil depletion leads to lower yields on exploited land;

• We are heading towards a world with 9 to 10 billion people;

• The evolution of agricultural production must include the issue of deforestation;

• The social inclusion of women and young people remains a major challenge to keep the younger generations in rural areas;

• 78% of the poorest people live and work in rural areas and depend mainly on agricultural activities.

These are key reasons to promote better use of existing land and restoration of soils for better environmental health and more equitable business opportunities… Yet the uptake of regenerative agriculture remains stalled at scale, especially at the first mile of agricultural value chains, at the level of small farmers.

The Expected Outburst of Voluntary Carbon Markets

On the other hand, the so-called voluntary carbon markets (VCMs) are entering a promising, if probably turbulent, decade. The AFOLU (Agriculture, Forestry) segment will continue to represent a significant part of carbon programmes but will increasingly need to integrate the fragmented supply chains involving hundreds of millions of small farmers.

Expectations for the global market range from USD 30 billion to USD 150 billion over the decade, with the first billion-dollar mark reached in 2021… So much for the likelihood of confusion. The only way to avoid accusations of green or SDG washing, as the credits generated in this way are akin to indulgences, will be to establish the solidity of the social impact provided and the real additionality of the approaches implemented.

The Necessity of a Fair Transition

Indeed, the environmental transition can only take shape if it is part of a framework of social justice. There can be no climate transition if it is not fair. Thus, the inclusion of small farmers in this future development of carbon finance is imperative, as much for reasons of equity as for reasons of acceptability. In the face of land scarcity and in view of these equity objectives, actions on existing farms to encourage changes in practice and the adoption of regenerative agriculture can rely on the anticipated rise of voluntary carbon markets to find additional financing while providing real environmental impact and value redistribution. Furthermore, it is also an opportunity to future-proof development projects, giving them the means to be sustainable and self-financing to fully benefit from their implementation efforts, through offset markets. All of these elements are excellent reasons to include more and more small farms in carbon finance projects, especially in emerging and developing countries, and to promote the transition to regenerative agriculture.

A Number of Obstacles… That Digital Solutions Can Help Overcome

However, there are many financial and operational barriers to this need:

• Price of the Ton of Carbon Equivalent for a long-time anemic;

• High cost for the qualification and monitoring of credits as well as for transactions;

• Uncertainty of emission levels;

• Above all, it is difficult to induce changes in practices and to ensure the long-term participation of small farmers.

Therefore, it is necessary to think of the schemes at scale, at two levels.

• Validation, monitoring and issuing of credits: analyses combining different sources of data, field & satellite for example, data science approaches for identifying and processing abnormal data (outlier spotting, redundancies, sampling, etc.) make it possible to process large samples by cross-referencing with field approaches;

• Sharing the value created with farmers and stakeholders, in cash and in kind.

By broadening the debate, this could more extensively advance the operationalization of mechanisms for valuing externalities (as voluntary carbon markets are a typical example), in multi-stakeholder coalitions or through impact bonds: at the social level, such as gender equality actions, or at the environmental level, around biodiversity for example. The robustness of impact approaches will indeed be the most reliable guarantee of the multi-stakeholder coalitions required for the emergence of regenerative economy models

Picture designed with Freepik

20+ years of experience in investment & asset management.

Raphael Hara works on relationships between finance and sustainability, in particular through the development and management of impact investment funds and projects.