Ksapa recently organized a webinar presenting a new class of financial instruments – impact linked finance – and their potential to accelerate the transition of agricultural supply chains towards regenerative agriculture. The need to transform commodity supply chains becomes ever more pressing with the increasing challenges – demographics, inequalities, climate change, soils exhaustion… – that the world is now facing. Agriculture is simultaneously part of the problem – 13 to 21% of world’s GHG emissions – and of the solution, as soil can stock huge amounts of carbon and shelter biodiversity. Stakes are even higher for smallholders who represent 25% of the world’s population and face great challenges while having little to no access to training – 80% of smallholders.

The question then arises as to how we can accelerate the transition? What are the tools that will help unlock private funding to support the required changes? And equally important, how can we make sure that this transition to sustainability is fair and inclusive towards smallholder farmers in the Global South?

To share actionable strategies, instruments, methodologies, and collaborative initiatives, we welcomed the insights of Regina Rossmann, Senior Associate at Convergence Blended Finance, Marie-Aimée Boury, Head of Impact-Based Finance at Société Générale, and Jyoti Banerjee, co-founder of North Star Transition.

Challenges of the Transition Towards Regenerative Agriculture

WITH INCREASING CHALLENGES, TRANSITION MUST BE ACCELERATED

World agriculture is now at the crossroad of multiple issues that highlight the need for a transformation of current food and commodity systems. Indeed, with the perspective of a 10 billion people world, how can ensure sufficient food production while preserving forests, biodiversity, and ecosystems? Additionally, with ageing rural populations and the youth migrating to cities, the very people food production relies upon are slowly leaving their farms. This phenomenon is reinforced by farming’s low attractiveness, mainly due to structurally low revenues and harsh working conditions, which fuels rural exodus. Furthermore, agriculture being inherently plagued by gender and social inequalities, the renewal of farmer populations and long-term stability of supply is jeopardized.

Besides farmers, production systems are also threatened by soils exhaustion and climate change, further affecting the quality and stability of harvests. To tackle the adverse impacts of climate change, top-down regenerative agriculture programs have been implemented, leaving out smallholder farmers and local communities from participating and reaping the benefits.

Considering the current context, it appears critical to accelerate the transition of agricultural supply chains starting at the first mile.

AGRICULTURAL TRANSITION REMAINS INSUFFICIENTLY FUNDED

While adopting regenerative practices and changing our approach to agriculture is fundamental to tackling these challenges, the transition remains insufficiently funded. In fact, only $220b of the $480b required annually for developing countries is actually invested, leaving an annual $260b funding gap to meet the food and agriculture SDGs. Moreover, financing the necessary shifts in practices, technology, and business models would demand an estimated $350b annually.

For smallholders, adopting new practices and transforming their farm operations requires funding. However, due to their credit risk profiles, most farmers either do not have access to finance or at prohibitive costs. Adequate support is needed to meet the wide range of financing needs of smallholders. As such, $14b a year until 2030 is required to double incomes of 545 million smallholder farmers.

As the SDG funding gap continues to grow – pre-covid gap was estimated at $2.5-4 trillion annually – mobilizing commercial finance to multiply the impacts of development finance is necessary. Additionally, to reach scale and exploit every dollar invested to the fullest, effective delivery systems need to be implemented.

New Financial Tools to Support Supply Chains’ Transformation

IMPACT-LINKED & IMPACT-DRIVEN INSTRUMENTS: A REAL ARSENAL

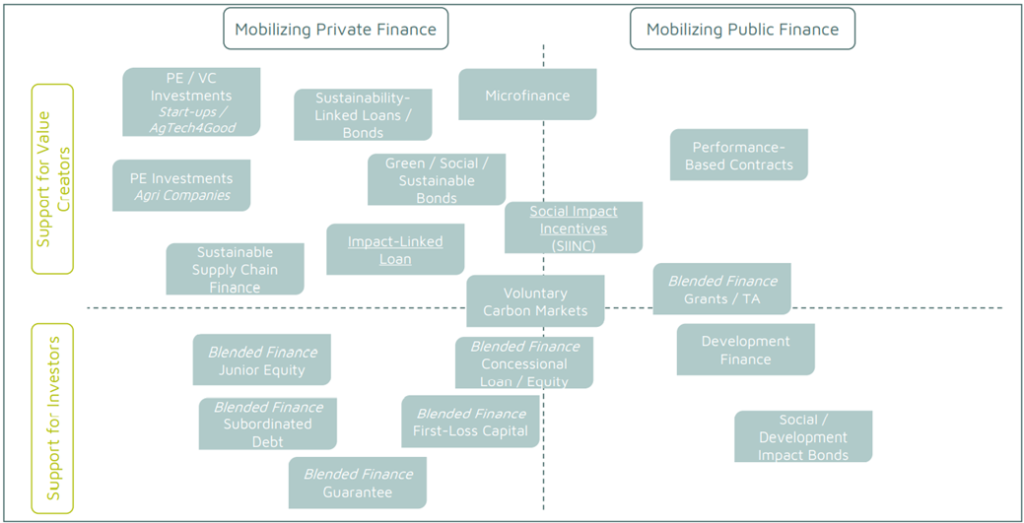

As the need for impactful solutions becomes more and more urgent, new financial tools that inherently incentivize positive outcomes have emerged. Impact-driven finance refers to the growing space of financial instruments that are used to achieve positive impacts.

Different approaches exist, providing more support to value creators – the companies and organizations contributing to the SDGs – or to investors who support those entrepreneurs. This can range from traditional private equity investments in starts-ups and agritech companies, to more sophisticated instruments, such as social impact incentives, or blended finance structuring approaches. The latter has been developed with the aim of leveraging concessional finance – from development agencies, foundations… – as a catalyzer to mobilize additional private finance which provides the necessary resources to significantly contribute to the SDGs. An overview of impact-driven financial instruments is provided below.

On a global standpoint, this new financial space is geared towards directing money to impactful ventures, in an effort to mainstream effective delivery systems.

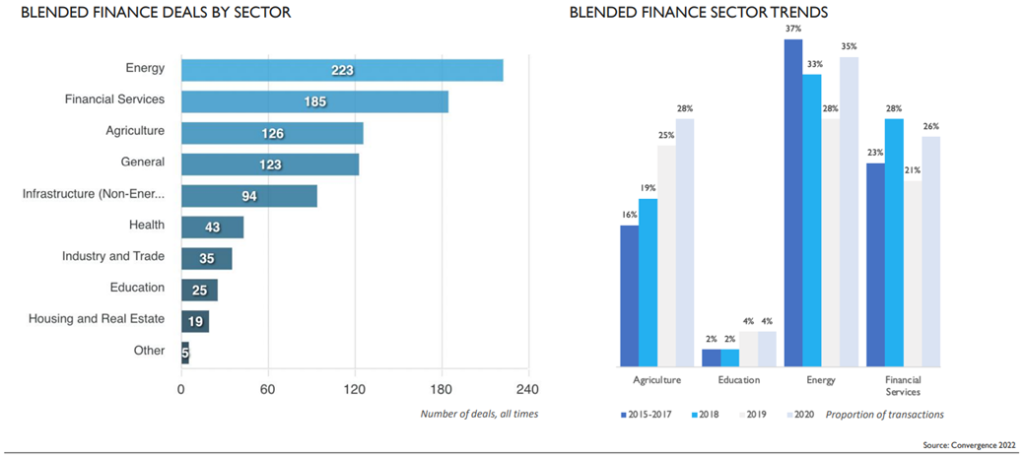

BLENDED FINANCE: MOBILIZING PRIVATE CAPITAL FOR AGRICULTURE

The new report recently published by Convergence on the State of Blended Finance provides a promising perspective: more money has been going to funding agricultural transition, through organic inputs or forestry conservation for example. However, most of the money is still flowing towards mitigation actions. Climate finance investments need to be redirected towards adaptation, to ultimately benefit agriculture, as stated by Regina Rossmann from Convergence. Today, only 3% of climate finance goes to agriculture as stated in the last Conference of Parties (COP): a 26-fold increase is needed by 2030 according to the Climate Policy Initiative.

One of the lessons learned in agriculture, is that guarantees & risk-sharing mechanisms are the most effective blended finance instruments for the sector. To drive the transition in agriculture, it is key to improve smallholders’ access to finance, so that they can invest in new practices. However, as smallholders usually do not have sufficient collateral to get a loan from commercial banks, providing guarantees to local banks prove effective. As such, one program in Tanzania is providing credit guarantee cover – sometimes up to 75% – to local commercial banks to top-up clients’ collateral for them to become eligible for a loan: what they found is that smallholder farmers are actually less risky customers than what was perceived initially.

Thus, for Regina Rossmann, the most effective blended finance approach to fund the transition of agricultural value chains is to pool different types of capital – concessional & private debt and equity – in a vehicle to provide risk cover for investors.

ROLE OF COMMERCIAL FINANCE: INSIGHTS FROM SOCIETE GENERALE

The importance of mobilizing private finance to achieve the transition of agricultural supply chains is now clear. In that sense, commercial banks play a crucial role in directing the flows towards contributive companies and solutions.

The first step for Marie-Aimée Boury from Société Générale, is to ensure that the bank’s clients comply with sectoral policies established by the bank, especially for companies dealing with sensitive commodities. This risk management approach must however be complemented by financing.

To go further, the bank has been structuring several innovative impact-driven instruments in recent years. For example, sustainability-linked loans (SLL) have been used several times to integrate sustainability-related objectives within the financing instrument. This way, Société Générale provided a SLL to commodity trader Sucden with integrated KPIs on child labor, seeds distribution, and water consumption in Africa and Asia.

The bank has also directly supported clients with sustainable business models, by providing loans to companies reducing deforestation or setting-up off grid networks in Africa. To consolidate their presence in Africa and offer support to SMEs, Société Générale has been developing SME houses in 9 countries to provide tailored support and strategic advice.

As reaching impact requires to innovate, Société Générale is also rethinking how they originate lending activities. In this regard, Société Générale has established a strategic partnership with Ksapa to experiment the SUTTI solution in Africa with the aim of financing farmers’ change of practices.

Strategies for a Sustainable & Impactful Transition

ENSURING A FAIR & INCLUSIVE TRANSITION FOR SMALLHOLDERS

In agriculture, fragmented supply chains, such as natural rubber, heavily on smallholder farmers. Their inclusion in transition to regenerative agriculture is key to achieve material impact. Globally, this represents around 500 million small-scale farms, with 2 billion people deriving their livelihood from small-scale agriculture. No effective transition if it is not fair & inclusive!

Inclusion in commodity supply chains also translates into specific actions to improve the youth and women’s social status and role in fragmented value chains. The long-term sustainability of many food systems depends on their participation.

To effectively include and support smallholders in the transition, they need to be financially supported to make the required shifts in practices and material. As mentioned before, providing access to finance to smallholders remains one of the key challenges, as their credit profile is usually deemed too risky by local banks and financial institutions. Even worse, when they can get access to finance, it is by subscribing to high interest loans – up to 30 or 40% – which eventually turns into debt traps. In that sense, intermediation is key to reach smallholders and drive the transition at the first mile of supply chains: interconnections need to be made between the large sums of invested in climate finance and the comparably very small amounts needed by smallholders. In this regard, Regina Rossman recommends leveraging impact-linked finance instruments to incentivize asset manager to provide financial support to smallholders.

ADOPTING A HOLISTIC IMPACT APPROACH

Another key aspect to a successful transition of agricultural supply chains is the approach to impact. Indeed, until today most problems were tackled in a “silo” manner, with projects focused on a single dimension: carbon sequestration, or biodiversity, or water consumption… On the contrary, to tackle the growing challenges agriculture and the world are facing, projects need to adopt a multidimensional impacts approach. Indeed, impacts are not stand-alone, but interconnected with each other. As such, improving biodiversity can have an impact on carbon sequestration for example.

This logic is at the center of North Star Transition’s landscape approach. The organization establishes country-level transition labs to reflect on how to turn de-generative systems into regenerative systems. The first target is Wales, where the lab brought together leaders from different organizations (farmers, finance, local authorities…) to discuss about the systemic change they want to see. From these discussions, the transition lab defines ambitions and workstreams for country-scale shift. In the case of Wales: healthy environment, sustainable food systems, participatory decision-making, coexistence and wellbeing of community, food, and nature.

One example of this endeavor showcased by Jyoti Banerjee – co-founder – is a program in Southwest of Wales aiming at transforming polluted rivers by involving 18,000 farmers, local treatment plants, companies… all polluters and stakeholders to emphasize all interactions between multiple sectors and disciplines that need to be considered for a regional level shift. This program aggregates small actions to be implemented, thus attracting more attractive financing.

North Star Transition however does not stop there. To go further in the reflections, they have set up the Regenerative investment lab. Through this space, stakeholders and decision-makers are invited to reflect on: which rules for establishing a regenerative system? How to get it started? Do we understand the crisis we are facing? What would the rules of a regenerative system be? How would it work on the ground concretely?

Moreover, this holistic approach to impact must be further complemented, by also accounting for potential negative impacts. Indeed, some positive actions can have negative consequences: think of biofuel which translates into large fields of monoculture crops, consuming vast amounts of water and sheltering little to no biodiversity. In this respect, multidimensional must consider positive but also negative externalities, for a more controlled approach.

REACHING SCALE

To reach scale and achieve material impact, it is necessary to increase the impact provided by every dollar invested. This concretely translates into identifying and mainstreaming the most effective delivery systems.

Following this logic, impact monetization – such as carbon credits – have take over the space in recent years. Combined with significant supply chains decarbonation programs from corporates, it can help compensate residual negative impacts through positive actions. In that sense, Société Générale has been looking at extending this logic to other areas, such as biodiversity credits.

Impact monetization is also promising as it can provide additional revenues to smallholders, in exchange for the ecosystem services (carbon sequestration, biodiversity protection…) they provide, as well as an access to finance and a lever to scale their business. All these aspects are critical to a successful and sustainable transition of agricultural supply chains.

Reaching scale also requires sizeable investments. Until now, development finance has been limited by the different scopes, interests, and motivations of financiers. Aggregating development finance, by aligning on common goals, will allow to attract the required resources from private funding and reach scale.

KSAPA’S SUTTI: FARMER-CENTRIC & SCALABLE SOLUTION

To support the transition of fragmented commodity supply chains to more regenerative practices, Ksapa has developed its own solution: the Scale-Up Training Traceability Impact initiative. Leveraging SUTTI, Ksapa has developed responsible sourcing programs for corporates aiming at reconnecting with the first mile of the value chain: smallholders. As an example, Ksapa developed a 1,000 natural rubber smallholder program in collaboration with Michelin Group and Porsche AG in Indonesia.

SUTTI is a large-scale impact program that leans on a hybrid capacity-building model. Ksapa combines in-person and digital solutions to boost farmers training and monitor impact in the process.

With capacity-building for vulnerable workers as a backbone, Ksapa’s value adding services hinge on 3 differentiators:

- Ksapa’s in-house expertise across the fields of Sustainability, Finance & Investment, Digital Solutions, Agronomy, Development Programs design and management and Impact Measurement.

- Ksapa’s lasting partnership with global organizations (IT Solutions, Carbon economy, Financial and Extra financial audit, Accountancy, Legal advice, etc.) & local experts.

- Ksapa’s federation of investors into impact investment schemes that target both financial performance and impact at scale.

Ksapa uses innovative finance to scale an approach designed for maximum replicability and adaptability at an economically acceptable cost. That is how SUTTI creates value for vulnerable workers, industrial corporates, and investors.

Conclusion

Transition of agricultural supply chains need to start at the first mile: with smallholders. Inclusive and fair transition is required for material impact. To achieve this, developing partnerships and intermediation to reach farmers, and scaling-up effective delivery solutions is critical.

On the financial side, standardization of financial instruments and procedures is required to develop and accelerate the pipeline of deals.

Across sectors and disciplines, fostering collaboration between “disconnected allies”, by highlighting common interests and motivations is the key to driving change.

Adrien is a SUTTI Program Officer. He’s responsible for the development, operational implementation, and monitoring of SUTTI programs. He participates in designing financial structuring schemes leveraging SUTTI’s impacts.

He has previous experiences in various industries, within public, private, and non-profit organizations. Before joining, he was involved in microfinance and social entrepreneurship initiatives in Cambodia and the Philippines, after working for Danone and RATP.

He holds a Master’s in Finance from Paris-Dauphine University, as well as a Master in Management from ESSEC Business School.

He speaks French, English, and Spanish.