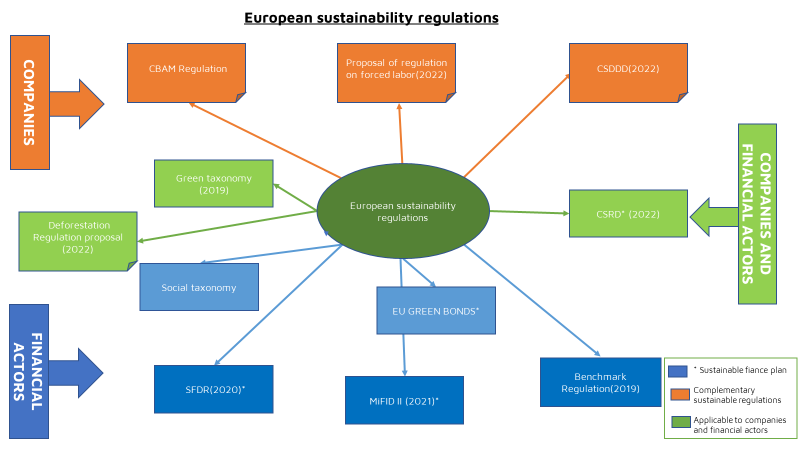

In late 2019, the European Union presented its “European Green Deal” and its Sustainable Finance Plan. This wide-ranging program of policy reforms aims to make Europe a climate-neutral continent by 2050, while ensuring a fair and just transition. The Sustainable Finance Plan for Europe aims to facilitate the movement of private capital into European sustainable development projects. Since then, the EU has adopted and initiated several regulations in the field of sustainability. The multiplicity, complexity and variable speed application of these regulations make them complex to understand and apply. This article offers some keys to decoding them.

1. Overview of European Sustainability Regulations

The EU so far has more than a dozen sustainability-related legislative acts and initiatives applicable to companies and financial actors. They are divided into two categories. On the one hand, there are the acts specifically related to the sustainable finance plan. On the other hand, there are those that fall under the broader sustainability agenda in general. Under the sustainable finance plan, the notable acts are the green taxonomy regulation, the sustainability reporting regulation (SFDR), the revised MIFID directive (MIFID 2), the extra-financial reporting directive (CSRD), the EU Climate Benchmark regulation, and the draft regulation on EU Green Bonds. Under other sustainability regulations, there is the draft regulation on zero deforestation, the directive on the duty of vigilance of companies concerning sustainability (CSDD), the draft regulation on products derived from forced labor, the draft regulation on social taxonomy, and the carbon adjustment mechanism at the EU’s borders (MACF).

2. Status of the Main Regulations under the Sustainable Finance Plan

To date, the European sustainable finance plan has six main instruments. They are the Taxonomy Regulation, the SFDR Regulation, the CSRD Directive, the MIFID II Directive, the EU Climate Benchmark Regulation and the draft EU Green Bonds Regulation. Some of them are already in force while others are still in the legislative process.

A. The Green Taxonomy Regulation

The Green Taxonomy Regulation establishes the criteria for determining whether an economic activity can be considered environmentally sustainable. This classification establishes the degree of environmental sustainability of different activities within the EU. Ultimately, the European Green Taxonomy will serve as a reference for environmental sustainability at the European level.

In order to be considered as a sustainable activity, the economic activity under consideration must satisfy two main tests – namely the eligibility test and the alignment test.

As far as eligibility is concerned, a given economic activity is considered eligible for the green taxonomy if it is included in the evolving list of sustainable activities contained in the delegated acts of the Taxonomy regulation. At this stage, the Commission has included ninety-four (94) activities in the list of sustainable economic activities through the delegated acts of the taxonomy regulation.

The alignment condition requires that the economic activity is aligned with one of the six environmental objectives. In this respect, the economic activity must meet the following conditions established by the technical criteria of alignment:

- First, it must substantially contribute to one of the six environmental objectives established by the regulation: climate change mitigation, climate change adaptation, sustainable use and protection of water and marine resources, transition to a circular economy, pollution prevention and control, and protection and restoration of biodiversity and ecosystems,

- Second, it must not cause significant harm to any of the other five environmental objectives (Do No Significant Harm principle),

- Finally, the activity must respect basic social criteria in line with the OECD guidelines for Multinational Enterprises and the UN Guidelines on Business and Human Rights.

In effect since July 12, 2020, the taxonomy regulation is now partially applicable. Its full application is scheduled for January 1, 2024. Since January 1, 2022, financial and non-financial companies must begin reporting, demonstrating the alignment of their activities with the first two environmental objectives (mitigation of climate change and adaptation to climate change) according to well defined criteria. As of January 1, 2023, non-financial companies must conduct full reporting while financial companies remain subject to a simpler reporting system. Full reporting for all companies comes into effect on January 1, 2024 – including reporting for other environmental objectives.

Once fully implemented, the green taxonomy will completely change the landscape of ESG reporting in Europe.

B. The SFDR Regulation

Adopted on November 27, 2019, the European Regulation on Sustainability Disclosure in the Financial Services Sector (SFDR) aims to establish harmonized rules for financial market participants and financial advisors on transparency with regard to:

- the integration of sustainability risks,

- the consideration of negative sustainability impacts in their processes,

- as well as the provision of sustainability information with respect to financial products.

In terms of reporting requirements, financial market participants must provide two levels of disclosures:

- At the entity level (Management Companies): they must publish their sustainability risk consideration policies as financial actors for all instruments, vehicles and investment funds under management. On the other hand, since June 30, 2021, financial actors with more than 500 employees must publish and update on their websites their due diligence policies with regard to the main negative impacts in accordance with Article 7 of the SFDR.

- At the product level: as of December 30 2022, companies must make PAI (Principal Adverse Impacts) declarations at the product level corresponding to the requirements of Articles 8 and 9 depending on the category under which the concerned fund or financial product belongs.

Indeed, the SFDR regulation requires asset managers to establish a classification of all their investment products according to their degree of sustainability. It distinguishes between :

- Article 6 funds that do not take ESG considerations into account,

- Article 8 funds that include ESG considerations,

- Article 9 funds that pursue a sustainable environmental and/or social impact objective.

Article 8 and article 9 funds are subject to special requirements for integrating human rights and other ESG considerations into their management system.

The SFDR regulation in its implementation is at the Level 1 stage. Indeed, SFDR 1 with respect to the initial regulation came into force on March 10, 2021. The SFDR Level 2 will start on January 1, 2023 with respect to the technical regulation standards (RTS) adopted on April 6, 2022. With SFDR 2, the firms and financial market participants concerned must make the first PAI report as of June 30, 2023, following the reporting templates provided in Annexes 1-5 of the Delegated Act on RTS.

C. MIFID 2 and EU Green Bond

i. MIFID 2

The revised Markets In Financial Instruments Directive or MiFID 2 Directive requires financial institutions providing investment and/or ancillary services to take into account investors’ ESG preferences in the definition of their suitability assessment questionnaires that they offer to clients. This is in addition to the consideration of investors’ financial profile, knowledge, and financial risk appetite, which has been in place since the MiFID regulation came into force.

Adopted on April 21, 2021, the MiFID 2 directive has been fully in force since November 22, 2022. Therefore, since August 02, 2022, financial institutions providing financial instruments must allow their clients to specify their ESG preferences through the profiling questionnaire. After collecting the ESG preferences of their clients and potential clients, these institutions must ensure that the ESG preferences of investors are matched to the various investment offers they provide and facilitate their monitoring.

ii. The Proposed Regulation on EU Green Bonds

The proposed regulation on European bonds, according to the European Commission, aims to define the criteria for qualifying a bond as a green bond, in order to better leverage the potential of the single market and the capital markets Union to contribute to the achievement of the Union’s climate and environmental objectives. In concrete terms, the voluntary European green bond standard will allow companies whose activities respect sustainability criteria to obtain financing from bond subscribers by claiming this qualification according to specific environmental criteria.

Published on July 6, 2021, the proposal has not seen any notable progress since then. It is still awaiting the intervention of the Council and the Parliament for its validation. The last modification relating to it was dated April 13, 2022 with a position paper of the European Council on the proposed regulation. In this position paper, the Council stated that it was “ready to enter into negotiations with the European Parliament in order to reach an agreement” on a final version of the text.

D. CSRD

The CSRD was adopted as a revision of the Non Financial Reporting Directive (NFRD). Its main purpose is to ensure that companies provide the best information on the sustainability risks they face and their own impacts on people and the environment, thereby making companies more accountable and transparent. One of the major innovations of the CSRD is the broadening of the scope of the directive compared to the NFRD. Approximately 50,000 companies are now concerned instead of 11,000 under the NFRD. In addition, the directive introduces the notion of double materiality as well as new ESG reporting requirements according to well-defined themes.

In particular, this extra-financial reporting will be articulated in 3 levels:

- cross-cutting indicators for all sectors and activities

- sectoral indicators for 10 priority sectors (expandable to 40 sectors within 3 years)

- indicators specific to each company.

In its implementation schedule, the CSRD will come into force partially from January 1, 2024, and then completely in 2028 with its application to companies from third countries. It’s coming into force will follow a gradual and variable application approach, according to the nature of the companies (financial and non-financial). Indeed, from January 1, 2024, companies falling within the scope of the NFRD must report in accordance with the technical standards determined by EFRAG and adopted by the Commission in November 2022, established with a view of simplification and international interoperability, particularly in conjunction with the ISSB. Gradually, the regulation will apply in January 2026 for companies not currently subject to the NFRD, in 2026 for listed SMEs, and in 2028 for companies from third countries exporting to the EU.

E. The Benchmark Regulation

The Benchmark regulation, which has been in full force since January 1, 2022, aims to introduce ESG criteria into the stock index market. It aims to offer investors with ESG preferences an alternative to traditional stock market benchmarks by introducing two new climate indices. The first index is the Climate Transition Benchmark (CBT). The second index is aligned with the Paris Agreement (Paris Aligned Benchmark, PAB).

The Benchmark regulation imposes two main obligations on stock market index providers. Since December 31, 2021, they must publish information on the alignment of their calculation methodologies with the emission reduction targets and the objectives of the Paris Agreement. And since January 1, 2022 – all index providers must commit to marketing at least one climate index. Index providers marketing these climate indices must also comply with the technical standards contained in the 14 articles of the delegated acts published in September 2021.

All of these regulations highlighted above have the common goal of creating a legal framework favorable to the orientation of capital towards sustainable activities in the European Union. They are complemented by other regulations focusing more on the EU’s sustainability agenda.

Conclusion: Ksapa is at the ready to assist you in your compliance efforts

Ksapa has developed an expertise of several decades in the calibration and reporting of financial and non-financial information. Our team based between New York, Paris and London mobilizes concrete methodologies of evaluation and critical analysis to help various economic actors to align themselves with the requirements of the current reporting frameworks. We work to align with the EU taxonomy, the SFDR and the NFRD/CSRD with an understanding of other regulatory requirements – SEC in the US, for example – in order to help your teams better mobilize liquidity. It is on these bases that we will be able to guide the efforts to adapt companies to the environmental, social and ethical challenges of the coming years.