In the face of uncertainty, socio-environmental excellence is emerging as a solution of choice. In this blog, we examine conditions for companies and their investors to step up to the plate.

Tag Archives: Sustainable Finance

It’s time for investors to scale ESG funds portfolio-wide. Ksapa delves into navigating the corresponding market and regulatory incentives.

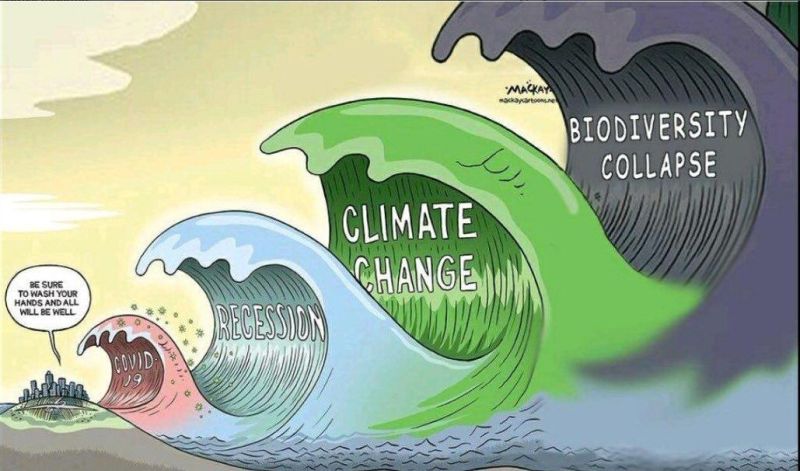

If 2020 was the year chips all fell into place, 2021 kickstarts action against the 2030 Global Agenda. Marred by a pandemic shock, the last 12 months exemplified the impacts of interwoven climate, social and digital crises.

2020 is coming to an end. A momentous year, it warrants particular reflection. In open discussion with our customers and partners, we draw the following 3 key learnings

Materiality analysis will capture stakeholders’ changing priorities during and after the Covid-19 pandemic.

To advance responsible and business conduct amid conflicting cost-cutting policies, companies must engage stakeholders better, faster and more broadly. Ksapa shared 5 priority areas for immediate action and opened the conversation on challenges and solutions to the expert insights of Susanne Stormer (Novo Nordisk) and Christèle Delbé (Bonsucro).

The PRI issued new recommendations to encourage investors to mainstream Human Rights due diligence. In this blog, Ksapa outlines a multi-year plan for investors to step up to the plate.

Explores some of the challenges venture capital fund general partners (GPs), limited partners (LPs), and founders face in managing ESG issues and proposes a road map of strategies the industry could take along three pillars

How to mainstream sustainable consumption behavior? Key Learnings from the Sustainable Share Index outlined in this article.

Several initiatives are being developed with a view to harmonize reporting standards for corporate Environmental, Social and Governance (ESG) disclosures. The goal is to instill more consistency amid multiple preexisting reporting frameworks, in hope these streamlining initiatives do not come to contradict one another. Here are 3 essential principles for the development of such a standard.