A practical framework for private equity investors to assess human rights risks and implement effective due diligence processes

Category Archives: Sustainable Finance & ESG

Sustainable investment, ESG strategy

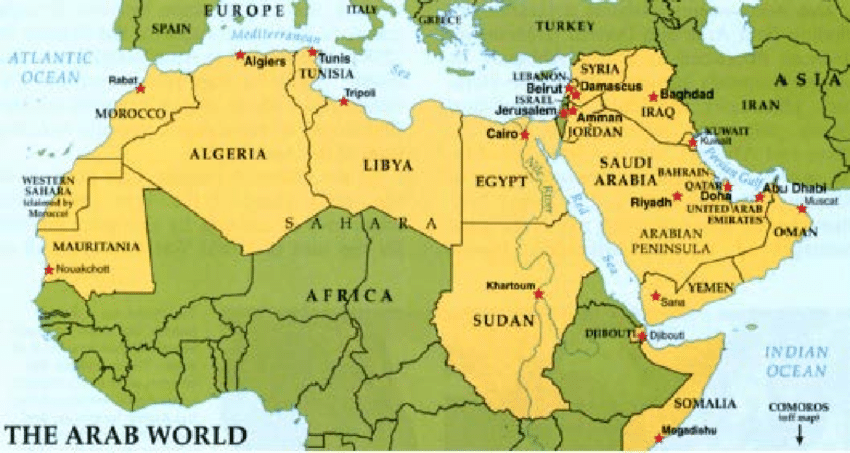

How financial actors can foster the development of a robust ESG practice and promote responsible business conduct in the MENA region.

With the rise of the CSRD, a more exigeant and demanding sustainability european directive is put in place. What to expect for 2024 ?

The Corporate Sustainability Reporting Directive (CSRD) comes into force at the turn of the year of 2024. The time for consistent and comparable reporting, in line with the European Sustainability Reporting Standards (ESRS) begins. The aim of this new regulation is to ensure that sustainability information is given the same importance and treatment as financial […]

Key 2024 trends driving fair decarbonization for EU-based and EU-trading asset companies amid new climate regulations

The COP series has reached a terminal phase of effectiveness. Let’s take a look at the role now expected of local authorities to bolster climate action.

Navigate ESRS living wage requirements. Learn key compliance steps and best practices for implementing adequate wages globally

With COP leadership gaps, boards of directors must drive corporate climate action through territorial and civil society partnerships

Understanding the 12 European Sustainability Reporting Standards (ESRS) that define mandatory ESG reporting under the EU’s CSRD framework

Leaders must guide organizations through environmental constraints to build sustainable economies. Insights from ESSEC’s change seminar.