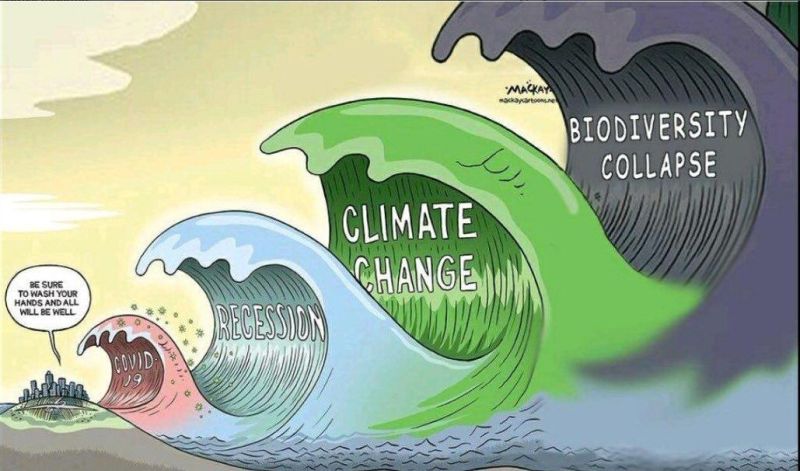

If 2020 was the year chips all fell into place, 2021 kickstarts action against the 2030 Global Agenda. 2021 is the year for the sustainable transformation of business and finance. Marred by a pandemic shock, the last 12 months indeed exemplified the impacts of interwoven climate, social and digital crises. In this piece, Ksapa delves into what it will take to make 2021 the year of business and finance.

Covid-19 Crystallized Climate, Social and Digital Crises

2021, a Year of Engagement and Accountability Across ESG Impacts

Ksapa expects 2021 to be a year of engagement and scrutiny from all sides, across ESG impact, Human Rights Due Diligence, corporate accountability and biodiversity commitments. As such, the greater risk is no longer being the first mover, but loosing relevance altogether.

In the context of lingering Covid-19 uncertainty, cross-supply chain ESG prioritization will make or break a business. We recommend economic leaders pinpoint their ESG strengths and weaknesses, to address any underlying issues. Only then may they channel stakeholder expectations of long-term resilience and non-financial regulatory compliance. We thus look onto the coming years as a the Delivery Decade, where businesses shift gears and display bold ambition and scale.

The time is ripe for decorrelating value creation and the environmental footprint of products, operations and supply chains.

2021 is the year for supercharging business and finance sustainability.

Ksapa’s Solutions for 2021 to Kickstart Sustainable Transformations

Embedded in our incorporative statutes is a commitment to actively partake in the public debate around sustainability. As such, we regularly share expert perspectives in our blog. Since Ksapa released its flagship Toward 2030 report, the ensuing year indeed confirmed our insights into the potential of technology and innovative finance!

Since then, you were among thousands of corporate and finance practitioners joining and referencing our webinars, blog articles and newsletters. Together, we explored new ideas, frameworks and tools to address the multifaceted complexity of #climate, #circulareconomy, #humanrights and #inclusivegrowth.

More importantly, our debates allowed us to look into how economic leaders can navigate concurrent crises while still innovating. And not only that but also accelerating their sustainable transformation. Ksapa kickstarted new projects. Our team developed long-term partnerships with global clients and global organizations. We worked with a global network of 150+ affiliates to ensure our services are highly specialized, localized and impactful.

So just what can we do to make 2021 the year we supercharge the sustainable transformation of business and finance?

1. Prioritize Your Priorities to Kickstart Sustainable Transformations

Take a global food company that makes most of its business through B2B activities, for example. Our contacts shared it came close to bankruptcy in 2020 because of serious cash issues. The group then decided to strengthen its inclusive growth policy across employees, contractors and business partners. The business case is clear: no cash = no business. No loyalty? No capacity to properly resume business, either.

As they kickstart a new year, numerous companies face comparable contradictory injunctions. In response, Ksapa and its network offer a platform of expertise, tools and methodologies to help you do all of the following:

- Get Your Mission, Vision and Purpose Right. For most executives, the challenges they managed in 2020 exemplified the role and value of their coworkers. We collectively strive not just for job stability, but also purpose in our professional lives. Our loyalty hinges on a clear purpose that effectively connects business and society. Purpose must make sense to us as coworkers and to our broader community of stakeholders. Ksapa’s briefing paper will help you address just that.

- Refine Your Materiality Assessment to Focus on Fewer Priorities. For most decision-makers, 2020 showed their sustainability efforts were never more timely and essential. Still, they will have to adapt to a challenging context in 2021 and will be expected to deliver even more with less resources. Taking a hard look at material issues to select, aggregate and focus even further will therefore be key. This recent blog article will help you to explore methodologies and get started in 2021.

- Focus (Limited) Resources to Amplify Impact on Select Priorities. Reporting on past performance along no longer cuts it. Consider forward-looking impact measurement. Supercharging the sustainable transformation of business and finance implies key economic players engage stakeholders better, faster and more broadly. To that end, Ksapa shared 5 priority areas for immediate action in this recent article.

2. Tackle Human Rights Risk Mitigation

2021 will likely be marked by more social unrest, which should be addressed by way of Human Rights commitments from investors, regulators and companies alike. This can only make sustainability transitioning as indispensable as it is be delicate. Growing regulations will also increasingly pressure corporations and investors to identify their Human Rights risks and resolutely work toward effective mitigation. Here’s how the Ksapa Network Can Support These Reflections.

- Comprensively Mapping Your Human Rights Risks. Businesses must build and execute their Action Plans. We operate in a complex environment, where companies face conflictual legal requirements. There is no better solution than developing greater awareness of the full spectrum of their potential risks and reaching the corresponding decisions. Ksapa meets that challenge with expertise, methodologies and partners, in order to support global financial and corporate institutions.

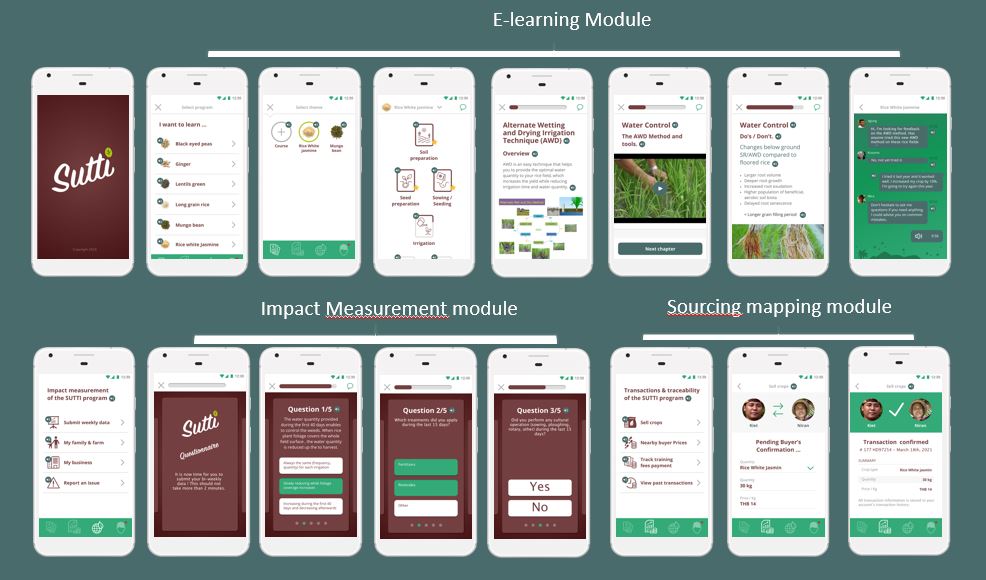

- Scaling Risk Mitigation Programs. The world does not need more pilots but scalable solutions to address environmental and Human Rights at scale. Ksapa combines sustainability, digital and finance expertise to design and deploy large-scale programs to help investors and businesses to mitigate risks. SUTTI is a flagship initiative we design to hone in on commodity supply chains. Through SUTTI, we onboard smallholder into risk mitigation programs and track progress with impact indicators.

Tracking and Documenting Risk Mitigation Actual Impact. Clients, regulators and investors are increasingly requesting targeted information to verify whether deforestation, child labor or other compliance issues are properly managed. Ksapa developed the methodologies, expertises and networks to work with financial and corporate organizations toward structuring, tracking and documenting these activities.

3. Scale Solutions for the Energy Transition

Soaring green bonds, revised disclosure regulation, climate stress-tests and the EU green taxonomy among others signal the greening of global finance. This is bound to encourage investment in the energy transition in Europe, which resonates with advantageously resonates with John Kerry’s ongoing efforts on behalf of the new Biden administration.

That said, these transitions stand at a pivotal moment, marred by profound crises. The real-economy is driven by overwrought companies that have invested too little, in a context where low interest rates too often offer negative returns for investors. Societies have been severely challenged by the global pandemic. Governments have jeopardized public finances in the long run to address their most urgent issues. Here are Ksapa’s proposed 3 tools to step up climate action.

- Closely Review Climate Risks and Opportunities. Then design climate strategy accordingly, in a way that covers products, operations and supply chains. Ksapa’s experts have worked on Science-Based Targets and climate strategies for 15+ years and can help you define bold strategies to align products, businesses and value chains with your corporate commitments.

- Build Alignment Across Functions, Operations and Strategic Sourcing Activities. As with any form of change, climate does not necessarily generate spontaneous adhesion. That is where Ksapa offers a unique approach to connecting the dots. How? We explore climate challenges from the perspective of multiple functions. This allows us to design climate solutions with just transition and Human Rights at their core. That is how we secure the acceptability of climate initiatives and share solutions fit for all business strategies and operations.

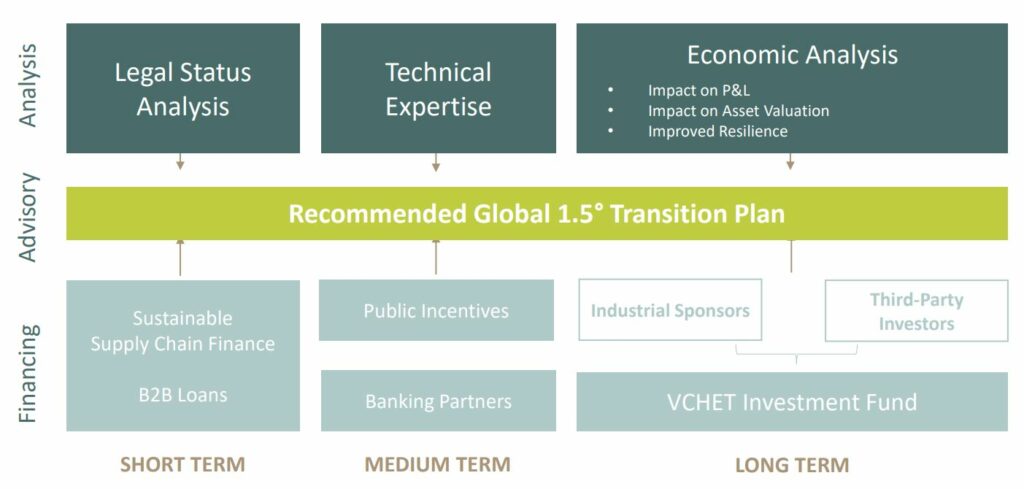

- Structure Financial Solutions for Both Operations and Strategic Partners. They otherwise cannot hope to access the necessary technical expertises and investment resources to scale efficiency, renewables and decarbonation. Ksapa therefore designed V.CHET, a long-term partnership with major industrial players. The climate initiative scheme consists in assembling a variety of different supply chain finance expertises and structuring financial solutions involving working capital to support the energy transition of operations and value chain. Ksapa’s program indeed includes 3 distinct components:

- The definition of a value chain-wide energy transition strategy through analyses and recommendations per key topic, an overarching vision and comprehensive monitoring.

- Our teams then design a financing plan to match recommended strategies.

- We finally carry out the operational implementation of selected solutions (energy efficiency, renewables, etc…) thanks to the mobilization of an ecosystem of technical partners.

Conclusion: Sustainable Transformations Better Faster, Together in 2021

Ksapa is in the business of rolling out concrete solutions. We therefore have ample reason to look onto 2021 with the energy and drive to accelerate our collective impact against the 2030 Global Agenda. So here’s to a year of delivery, full of enthusiasm and collaboration!

We look forward to sharing new ideas and tools to #BuildBackBetter, faster, together in 2021!

Président et Cofondateur. Auteur de différents ouvrages sur les questions de RSE et développement durable. Expert international reconnu, Farid Baddache travaille à l’intégration des questions de droits de l’Homme et de climat comme leviers de résilience et de compétitivité des entreprises. Restez connectés avec Farid Baddache sur Twitter @Fbaddache.